Partner

Steve Sloane

Steve is a partner at Menlo focused on investments in Menlo’s Inflection Fund, which targets fast-growing Series B/C companies. He specializes in AI-powered vertical SaaS investments and supply chain technology, including Enable, Eleos, Observe.AI, Scout, 6 River Systems, ShipBob, CloudTrucks, and Parade.

Steve joined the firm in 2015 as an associate, became a principal in 2017, and a partner in 2019. Prior to Menlo, Steve worked in growth-stage investing at Insight Venture Partners in New York and founded a YC-backed company in the social space. Steve graduated from Princeton University with bachelor’s degrees in both mechanical and aerospace engineering and a minor in robotics and intelligent systems. Steve has two young boys and, in his free time, enjoys competing in triathlons (as much as one can enjoy them), skiing, following the New York Giants, and road biking.

Supported by: Dominique Guevara, [email protected]

Investment Portfolio

Milestones

-

2015 - Founded

-

2018 - Partnered, Series B

-

2019 - Acquired by Shopify

Partners

Milestones

-

2012 - Founded

-

2018 - Partnered, Series C

-

2025 - IPO; NASDAQ: CHYM

Leadership

Partners

Milestones

-

2019 - Founded

-

2021 - Partnered, Series B

Partners

Milestones

-

2020 - Founded

-

2023 - Partnered, Series B

Leadership

Partners

Milestones

-

2016 - Founded

-

2020 - Partnered, Series A

Partners

Milestones

-

2017 - Founded

-

2020 - Partnered, Series B

Leadership

Partners

Milestones

-

2014 - Founded

-

2018 - Partnered, Series C

Leadership

Partners

Milestones

-

2013 - Founded

-

2017 - Partnered, Series A

-

2019 - Acquired by Workday

Partners

6 River Systems

Carta

Chime

Clarifai

CloudTrucks

Eleos Health

Enable

Heap

MealPal

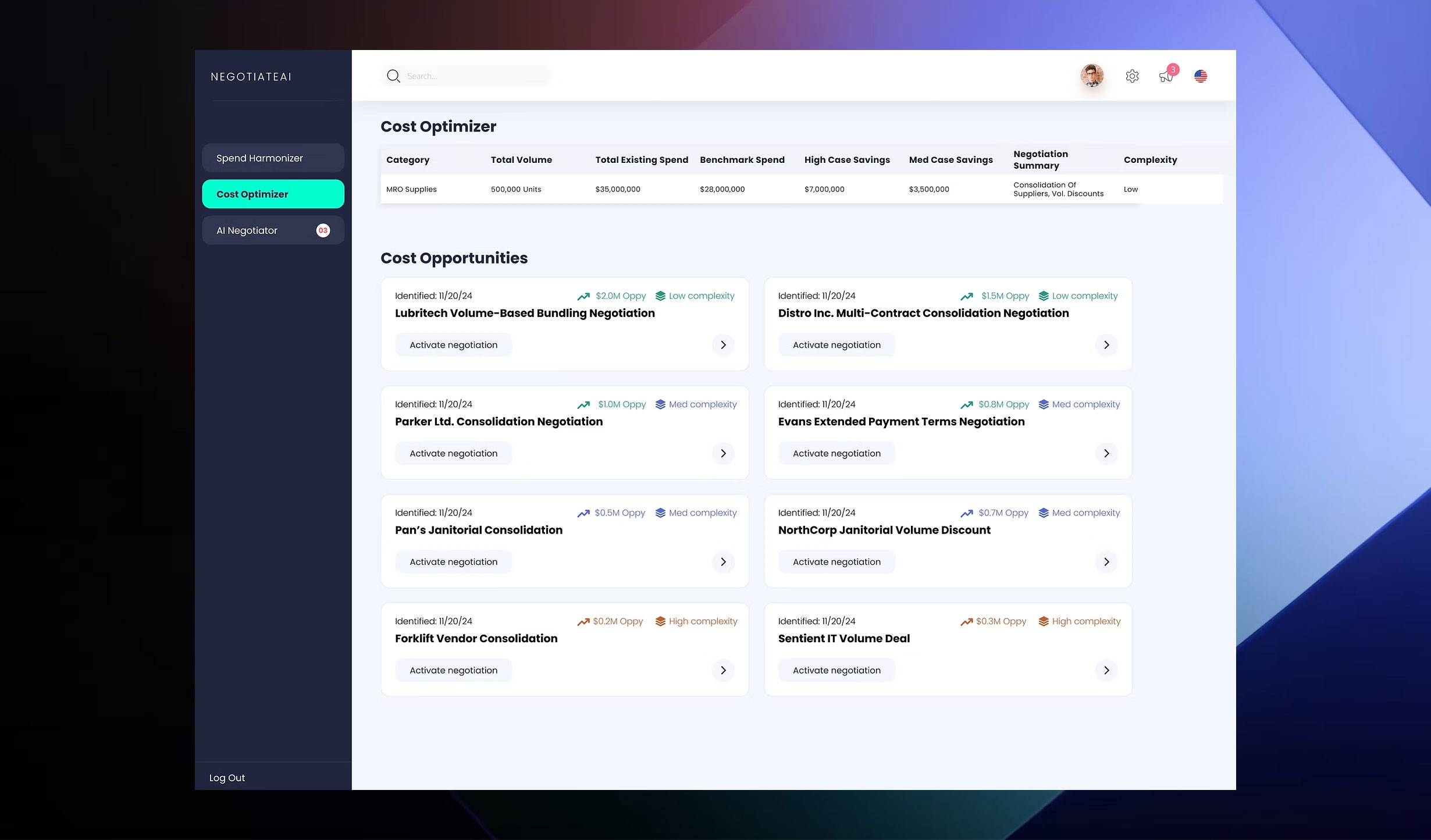

NegotiateAI

Observe.AI

Parade

Rover

later acquired by Blackstone

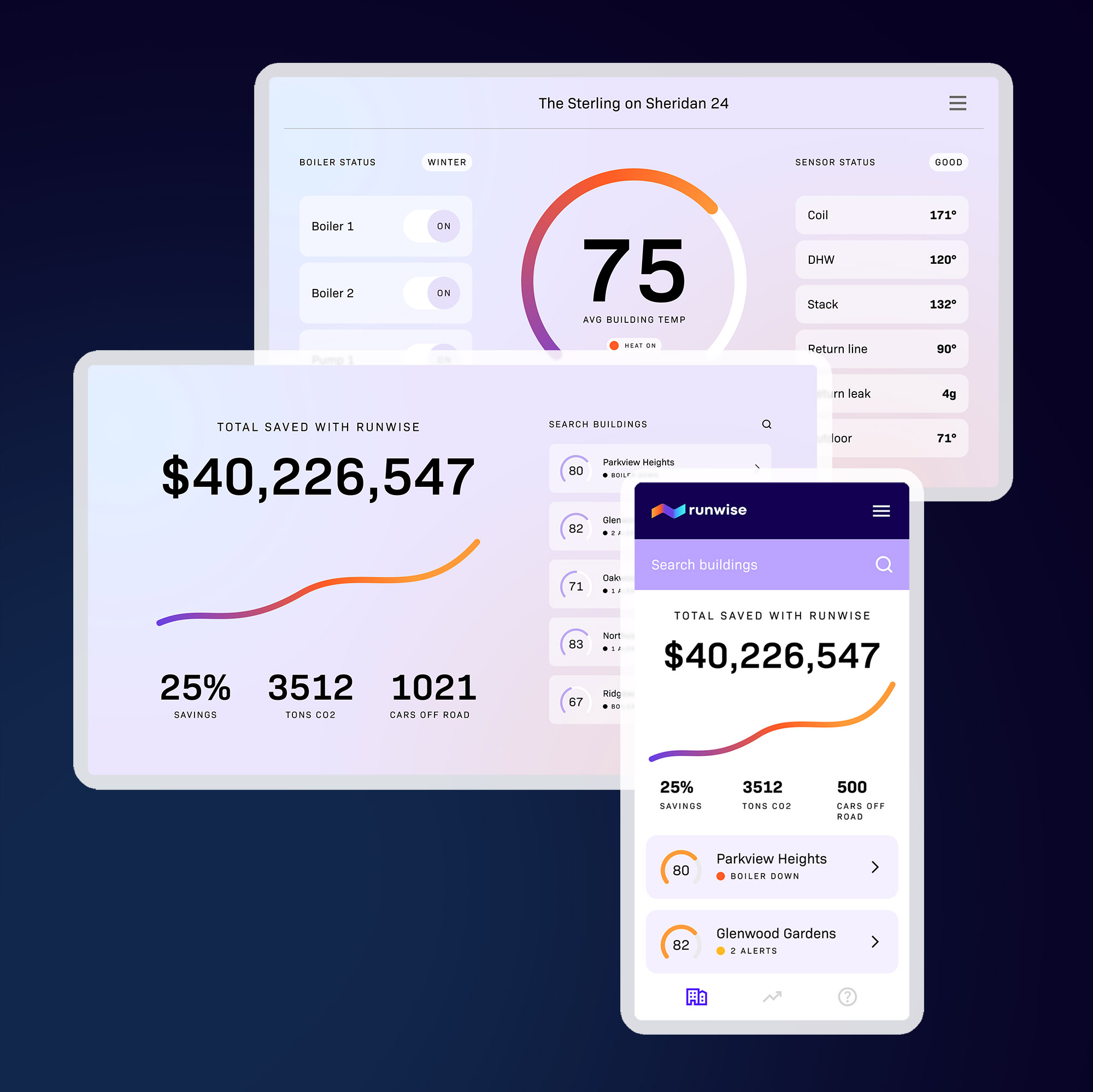

Runwise

Scout RFP

ShipBob

Sidecar Health

Truework

q&a

Investment Approach

Ultimately, I try to meet the moment when it comes to my interactions with founders. As a VC, I’m successful when I back great founders and management teams and let them execute. I’m there for founders when they need me, and we can talk multiple times a day during moments of high leverage such as key strategic decisions, M&A, fundraising decisions, hiring, etc. But when that’s not happening, I try to get out of the way and let the founder run their business. 🙂

VC is not right for every company, and each time founders decide to raise money, they are diluting themselves and committing to a larger and larger outcome. There are so many founders who have built tremendous businesses with more limited amounts of capital. VC is immensely powerful for certain types of businesses, but it’s not always the right answer, and founders should think deeply about each round they raise.

Building a great company is not a straight line, and it never goes exactly the way you plan for it. There are lots of ups and downs along the way, and many highs and lows. That’s true 100x more for a founder who places all of their chips on one company. It’s not about a single quarter, but rather the journey and conviction that hard work, vision, and adaptability will get you there in the end.