Partner

JP Sanday

Jean-Paul (JP) Sanday is a partner at Menlo Ventures who invests at the inflection stage. Focused on vertical SaaS and, more broadly, enterprise software, JP is particularly excited about companies defining the future of work, infusing our lives with intelligent automation and democratizing data analytics.

His favorite part of the job is partnering with passionate founders to build a business that matters. These relationships are informed by his own experience as an executive in hypergrowth companies, where he learned the critical role culture plays in setting up a company for success. His conversations often focus on the “job” a product is hired to do, and he firmly believes nailing customer retention is the best way to build a lasting company.

In 2019, JP came to Menlo Ventures from Summit Partners, where his board and investment experience included Smartsheet (NYSE: SMAR), Clearwater Analytics (NYSE: CWAN), Ascentis (acquired by UKG), and Teaching Strategies. He previously served as Vice President of Growth at online education platform CreativeLive (acquired by Fiverr), and Vice President of Growth at mobile games and entertainment company Kiwi. He co-founded a mobile ad network focused on driving high-quality installs for app developers, and spent time as a Product Manager at Amazon.

JP graduated summa cum laude from Boston College Carroll School of Management and earned an MBA from Stanford Graduate School of Business. He is Argentine and Peruvian by background, growing up in Argentina until he came to the U.S. on a college scholarship. Now, JP is building his family in the Bay Area. He and his wife have two daughters. When he’s not with his family or in the office, you can find him riding his bike or scuba diving somewhere in the Pacific Ocean.

Supported by: Karen Avila, [email protected]

Investment Portfolio

Milestones

-

2018 - Founded

-

2020 - Partnered, Series B

Leadership

Partners

Milestones

-

2014 - Founded

-

2020 - Partnered, Series C

Partners

Milestones

-

2015 - Founded

-

2025 - Partnered, Series C

Leadership

Partners

Milestones

-

2020 - Founded

-

2023 - Partnered, Series B

-

2025 - Acquired by Braze

Leadership

Partners

Milestones

-

2012 - Founded

-

2021 - Partnered, Series B

Leadership

Partners

Milestones

-

2016 - Founded

-

2022 - Partnered, Series B

-

2025 - Acquired by Workday

Leadership

Partners

Milestones

-

2022 - Founded

-

2025 - Partnered, Series B

Leadership

Partners

Abnormal AI

Anycart

Ascentis

Clearwater Analytics

CodeSignal

CollegeVine

H1

Knoetic

Netlify

OfferFit

Photomath

Qualio

Sana

Smartsheet

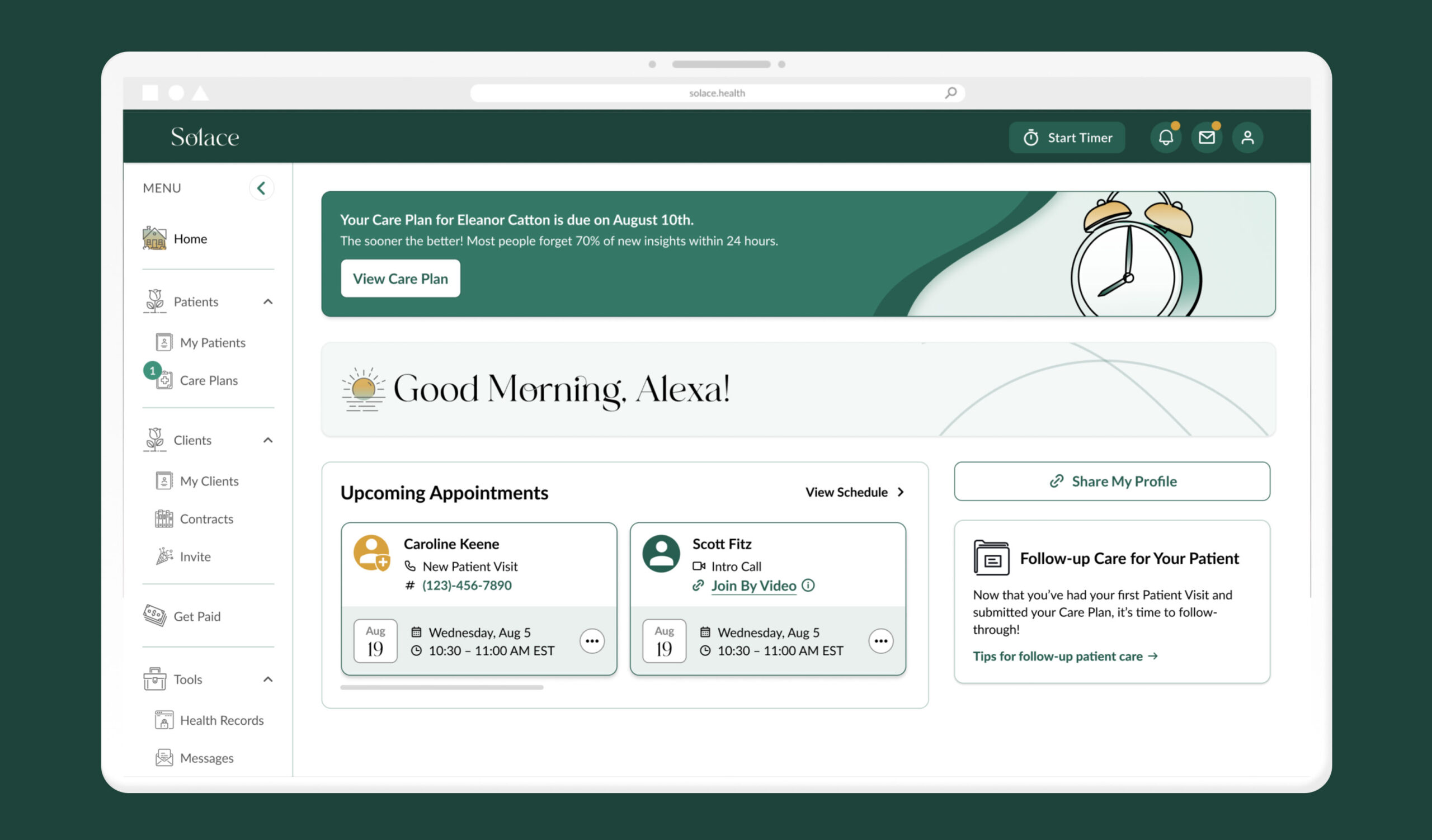

Solace

Teaching Strategies

q&a

Investment Approach

Being able to navigate a dynamic market and changing landscape are skills all founders should master—this means clarity of vision is critical. Translating that vision into world-class execution is very difficult, but you can tell which founders are obsessing over this from early on. Many smart people can make a great PowerPoint, but marshaling resources and people to execute that plan is a talent.

I usually look for the “4 Hs”: horsepower, hunger, hustle and humility. When I see that powerful combination in a founder attacking an interesting market, I’m usually compelled to go all in.

Treat your cap table like a product—craft it the right way for it to align with your market opportunity. VCs are in the business of identifying inexorable trends that translate to a market undergoing significant (usually sudden) change that creates the opportunity to build a “venture business” that will produce venture returns. This means the demand for that product or service is being manifested in unnaturally short, compressed timeframes for the company to grow quickly without burning through all of their capital.

Many markets can support growing companies and are attractive, but they might not be “venture-ready” markets; there isn’t that unnatural manifestation of demand.

Too many times, founders start with their cap table thinking they need to raise venture capital, and then they architect a hypergrowth plan that those VCs like to see (insert hockey stick chart here!) and then they justify it with an explanation of the market size.

I think it should be the opposite: Start by really understanding the market, the demand patterns and changes happening that create the opportunity for the company, then put together an ambitious but realistic plan. Given that exercise, you can decide what the right cap table is to pursue that opportunity. Every round you raise you should be rinse and repeat—after all, you’ll have a lot more information about your market!

Treat the process of picking your next investor like a hiring decision. It will likely be the most important “hire” you will make that year, so spend time with them the same way you would for recruiting a new leader to the company.