All Articles

FirmPortfolio

Last week, we brought together leading CISOs, founders, and security practitioners for our 2026 AI Cyber Summit. The backdrop was hard to ignore: Anthropic…

PortfolioFunding

The IDE That Biology Never Had: Why We’re Leading Phylo’s Seed Round

Phylo is building the IDE for biology, a unified environment where scientists can finally work at the speed of their thinking.

PerspectiveHow To

There Are No AI Markets, Only Proto-Markets: Why the SaaS Playbook Fails in AI

Today’s AI markets are noisy. Code generation, customer support, and legal each have five-plus credible leaders; emerging categories have dozens more overlapping products with…

PortfolioFunding

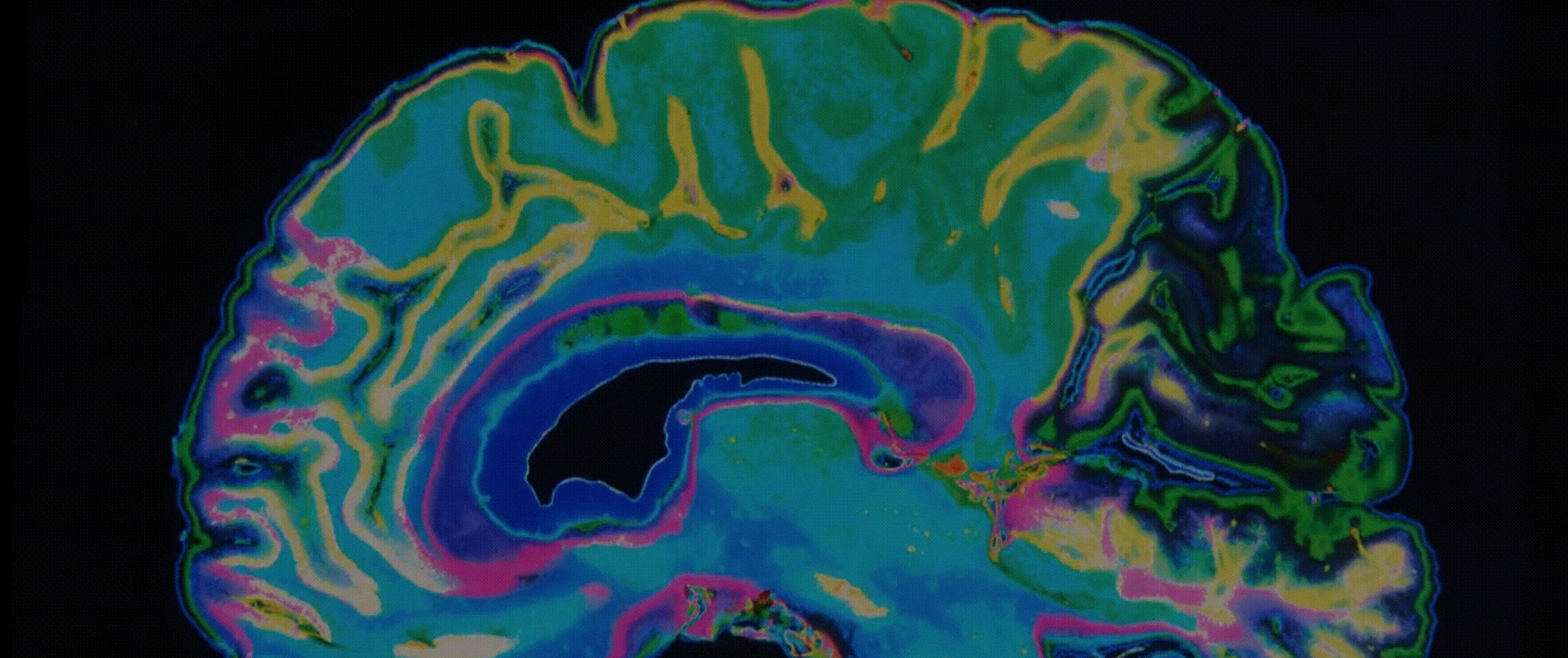

Aurora: Developing Therapies for the Millions of Patients with Rare Diseases

Johnny began his Ph.D. evolving new Cas9 enzymes in 2012, the same year that Jennifer Doudna published her seminal paper unveiling CRISPR as a…

Firm

Celebrating Deborah Carrillo’s Promotion to Partner

I’m thrilled to announce that Deborah Carrillo has been promoted to Partner at Menlo Ventures. This is recognition of someone who’s been instrumental to…

PortfolioFunding

Software Creation for All: Leading Lovable’s $330M Series B

Menlo Ventures is excited to co-lead Lovable’s $330M Series B round with CapitalG and help Lovable enable the next generation of builders.

PerspectivePortfolio

2025: The State of Generative AI in the Enterprise

For all the fears of over-investment, AI is spreading across enterprises at a pace with no precedent in modern software history.

FundingPortfolio

Ushering in the New Guard of Vulnerability Management: Menlo Leads Zafran’s Series C

Zafran’s platform reimagines vulnerability management as an intelligent system that understands actual exploitability and takes autonomous action, consolidating what has historically been fragmented across…

PerspectivePortfolio

Agents for Security: Rethinking Security for the Age of Autonomy

With millions of unfilled positions and increasing threat volumes, cybersecurity is facing a scale challenge that only autonomous AI can solve.

PortfolioFunding

The Future of Music Is Participatory: Leading Suno’s Series C

Music has been a big part of my life. I started playing the piano when I was 4, classically trained, and performed internationally before…

PortfolioFunding

Investing in Agency’s Series A: The AI Operating System for Customer Relationships

Agency is positioning itself to become the system of record and intelligence layer for all customer interactions—from first touch to renewal and expansion.

PortfolioFunding

Q3 2025 Anthology Fund Update

We’re excited to announce that the Anthology Fund portfolio has now grown to 45+ companies with 12 new additions this quarter.