It’s rare to meet an entrepreneur who demonstrates both an incredible command of their business and such a clear vision of the magnitude of the opportunity. Benchling’s Sajith Wickramasekara “Saji” is that entrepreneur. We knew even before meeting that the company was a great fit for Menlo: big mission, high-quality team, and a transformative product embraced by a wide range of customers. Then we met Saji, and it was a no-brainer. Oh, and outstanding SaaS metrics and efficiency completed an already special picture.

The life sciences sector is on a tear, delivering innovation at an unprecedented pace. New therapeutics (including potential cures from gene therapies) and diagnostics (some based on new genomics technologies) are changing the healthcare landscape. In contrast to this cutting-edge innovation, the software environment in many of these leading-edge companies is stuck in the past, remaining analog and/or disconnected. Benchling’s mission is to fix that. It’s in their DNA: Saji and his co-founder Ashu Singhal come from families of researchers. They experienced the problems firsthand, visualized the technology solution, and set out to create it.

It started with free software for researchers that would replace a lab notebook (yes, this is still considered the state-of-the-art system of record for research work!) with an ELN (electronic lab notebook). They also created a flexible digital model of molecules and a collaborative end-to-end workflow for the entire research team. The platform brought researches together to share their work and collaborate on projects while building a digital system of record of the science (molecule, compound, method, etc.). After attracting hundreds of thousands of users, the company was getting more and more demand to build a commercial version that added more enterprise capabilities like project management, cross-project visibility, real-time views of development progress, and resource allotment. That product is a hit. Pharma companies ranging from the smallest of upstarts to the most significant players in the industry have embraced Benchling. The potential is limitless.

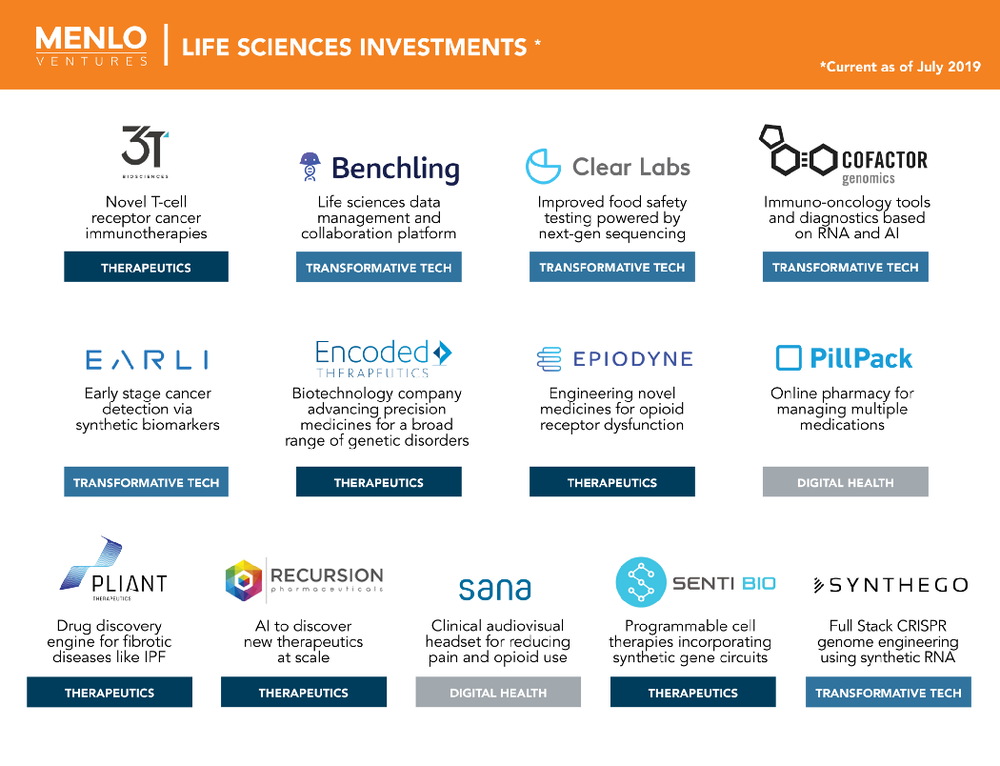

Given the magnitude of outcomes in life sciences—measured not only by financial returns but also by lives improved—Menlo recommitted to investing in the sector and three years ago tapped Greg Yap to lead the charge. Greg is a two-time founder and longtime life science exec turned venture capitalist. Given the sector interest, Benchling was a perfect fit for Menlo as it combines our interest in fixing antiquated workflows with modern SaaS applications (my focus) and accelerating healthcare companies with technology (Greg’s passion). As is common at Menlo, we’re both excited to be collaborating closely with Benchling.

We’re excited to be backing Saji, Ashu, and the amazing team at Benchling. As the newest addition to Menlo’s vertical SaaS portfolio, Benchling is in good company with Qualia (real estate), Indio (insurance), HOVER + stealth investment (construction), and Carta (financial services).

With so many sectors stuck with old software and held back by antiquated workflows, Menlo is encouraged by the influx of entrepreneurs pursuing industry-specific SaaS. At the same time, the oldest of industries are seeking out innovation and embracing new solutions at an unprecedented pace. Vertical SaaS will re-architect many industries, and certainly, Benchling will be among those with the most profound of impact.

Matt is a partner at Menlo Ventures and invests multi-stage across AI infrastructure (DevOps, data stack, middleware, API platforms), AI-first SaaS (vertical and horizontal), and robotics. Since joining Menlo in 2015, Matt has led investments in Anthropic, Airbase, Alloy.AI, Benchling, 6 River Systems (acquired by Shopify), Canvas, Clarifai, Cleanlab, Carta,…