Today we announce a new fund: the Menlo Inflection Fund.

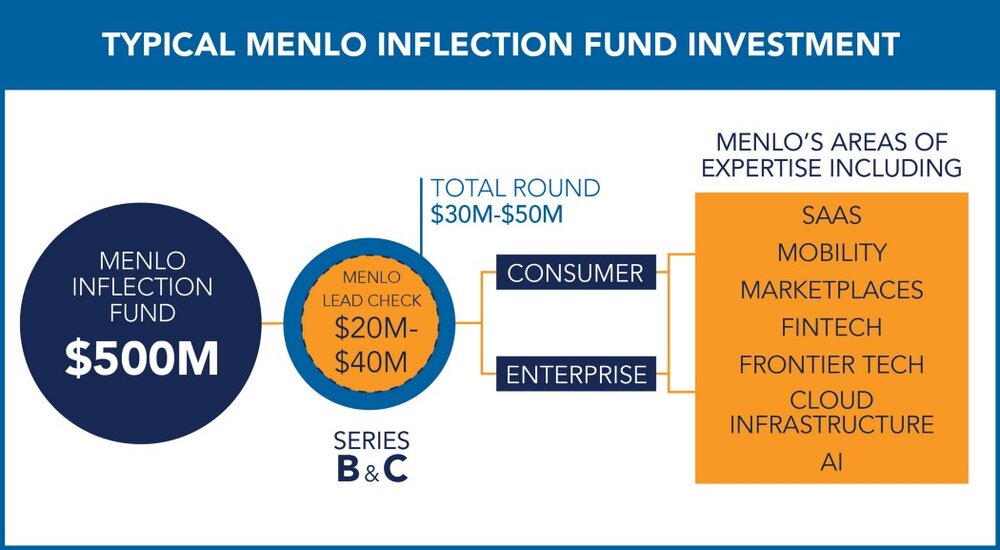

An inflection point is a decisive moment that marks the start of significant change. As startup investors, Menlo wants to drive that inflection. We designed our new $500 million Menlo Inflection Fund to target promising companies at the inflection stage, powering hyper-growth companies through the “venture gap” that lives between early-stage venture (Seed and Series As) and the increasingly competitive arena of mega-growth investing ($50 million to $200 million rounds).

If the former is high-ownership bets and the latter is piling into the proven winners, inflection is that delightfully ambiguous middle ground where data, execution, and risks—are all open to interpretation.

Inflection investing is backing companies that show early signs of enormous potential but lack the absolute scale of runaway winners. It is the juncture where a company’s potential is still unbounded, but the business has taken shape and can be evaluated through the sober lens of data and financial analyses, customer feedback, mental models and first principles. It is a time when the product is real, but uncertain execution against a product roadmap lies ahead. It is when the early go-to-market motions are working, but ramping is still fraught with risk. It is when culture, team, market—are all trending, but subject to change. If venture is the equivalent of wildcatting for oil, inflection is encountering an oil gusher and deciding whether to double down with investment, expertise, and infrastructure to transform that geyser into a mega well.

To us, it is funding greatness one click before it becomes obvious to the world. It’s the sweet spot we are drawn to and one where we excel. Betterment, BitSight, Bluevine, Carta, Chime, Envoy, Everlaw, HomeLight, PillPack, Poshmark, Qualia, Rover, ShipBob, Signifyd, Uber, to name a few, are all investments Menlo made at (or near) the inflection stage. Through these investments, we developed confidence in our pattern recognition, mental models, and processes both pre- and post-investment. Because of this, we want to go all in. Hence a dedicated fund.

Through the Menlo Inflection Fund, Menlo will make $20 million to $40 million investments in thematic and research-driven areas including SaaS, Mobility, Marketplaces, FinTech, Frontier Tech, Cloud Infrastructure and AI—touching large consumer and B2B markets. We will target companies that demonstrate:

- A beloved product

- Early product-market fit (with more than $5M in annual recurring revenue, but often less than $10 million)

- Rapid growth of more than 100% year-over-year

- Early signs of efficient economics, payback, and retention

- A strong founding team with a unique perspective on the opportunity and a desire to go all the way

The Menlo Inflection Fund will be led by Menlo Ventures’ Partners Matt Murphy, Mark Siegel, Shawn Carolan, Venky Ganesan, Tyler Sosin and joined by Steve Sloane, whose recent promotion makes him the youngest partner in Menlo’s 43-year history. The fund is the result of our insights—a candid assessment of our strengths as investors and more importantly our tendencies—and it is a nod to the realities of our industry and the shifting tectonic plates that brought stratification to the capital stack.

The announcement of the Menlo Inflection Fund caps a record run for Menlo. In the last 15 months, Menlo Ventures:

- Distributed $2.4 billion to our limited partners

- We added four new partners to our team, including the recent promotion of Steve Sloane to partner (The youngest partner in the history of our firm.)

- We expanded our focus to include healthcare

- We stacked our Fuel team with industry veterans who provide services where startups need them most: building world-class management teams, catalyzing go-to-market strategies and creating impactful connections across our community

- We opened a second office in San Francisco

If you are an inflection-stage company or an investor at the partner, associate, or principal level who wants to build the breakout companies of the future, we want to hear from you.

We’ve done this with Poshmark, Roku, and Uber. Who’s next?

Venky is a partner at Menlo Ventures focused on investments in both the consumer and enterprise sectors. He currently serves on the boards of Abnormal Security, Aisera, Appdome, BitSight, Breather, Dedrone, MealPal, Rover, Sonrai Security, StackRox, and Unravel Data. Prior to joining Menlo, he was a managing partner at Globespan…

Tyler is a board partner at Menlo Ventures focused on investing in technology-enabled services and products that are positioned to compound their growth efficiently for a very long time, vis-à-vis sticky long-term relationships with customers and partners. He has coined these businesses “layer cakes” (resulting from customer revenues looking like…