How to align product with what customers want, differentiate from competitors, and win your market

Myth: Breakout consumer startups are rare and elusive, and can only be stumbled upon via build–learn–pivot–repeat, until you catch lightning in a bottle.

Truth: While it’s easy to label the success of many of our most beloved consumer tech names like DoorDash, WhatsApp, Airbnb, and Chime as “consumer magic” there is a straightforward process that the best product companies follow. It starts with getting crystal clear on the important problem you want to solve (i.e., your “job to be done”), and ends—if execution is strong—with happy customers who no longer have that particular problem. Let’s elaborate.

Distill the core problem using the Jobs-to-Be-Done framework

Many product builders fall into the trap of building feature after feature in an attempt to make customers happy and build a big business. While this approach may appear to be the best strategy when you as a founder have a “grand plan” for the product having experienced the problem yourself, or when early customers are piling on their requests, this path of execution oftentimes leads to a team stuck in a cat and mouse chase building features that seem promising but fail to attract substantial retention. Anchoring your product roadmap against one, or very few, important Jobs, can be an antidote to this common trap and will save you time, capital, headache, and will get you on track to catching lightning in a bottle faster.

The Jobs-to-Be-Done (JTBD) framework was popularized by renowned Harvard Business School professor Clayton Christensen. As the Christensen Institute explains, the JTBD theory goes beyond conventional demographics and product attributes “to expose the functional, social, and emotional dimensions that explain why customers make the choices they do.”

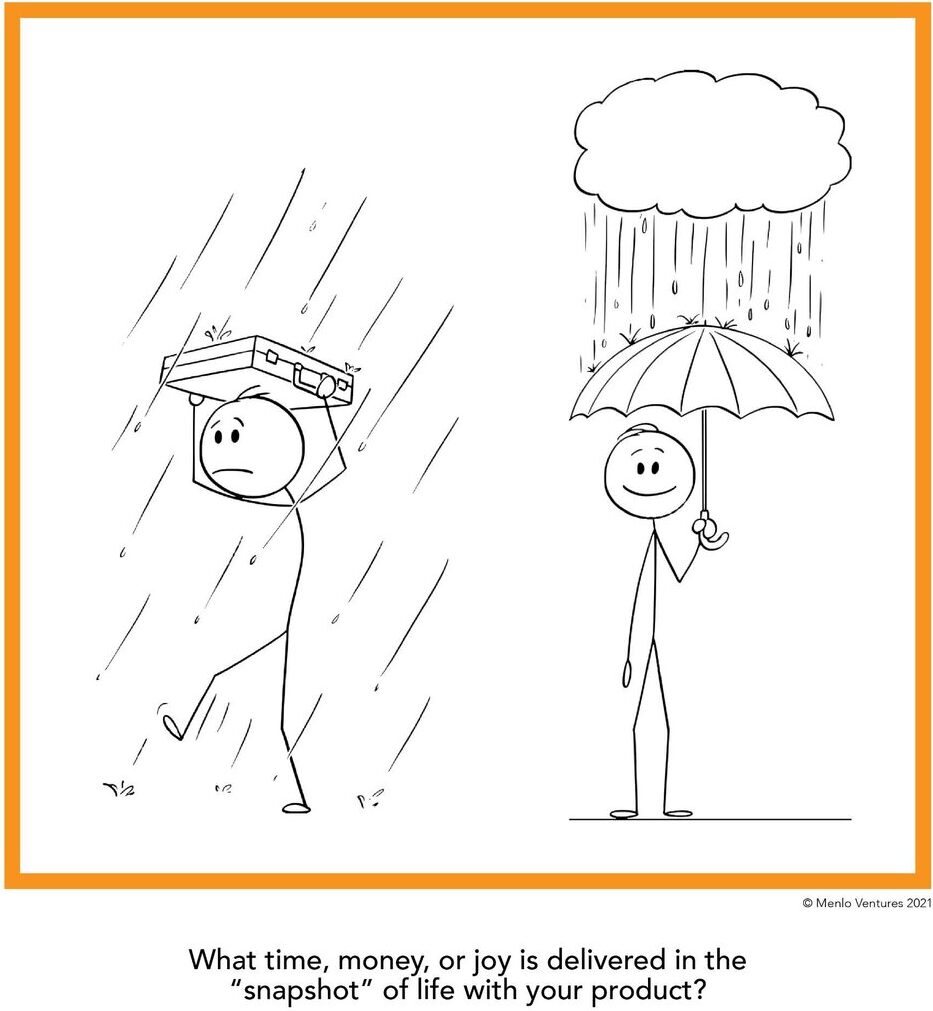

Put simply, most people don’t buy products because they like the underlying technology; they buy to accomplish a goal, and these goals can be subtle and vary based on context. Case in point: it’s much easier to convince a pedestrian they should buy an umbrella to stay dry during a rainstorm in NYC than during a sunny day in Phoenix, regardless of their demographic.

The consumer’s goal is the “Job” they are trying to get done; understanding this way of thinking—and how to specify it with precision—can align your team to execute toward a clear destination. In the scenario above, the “Job” is to stay dry during a rainstorm, and while the tool is the umbrella, the consumer isn’t married to the umbrella; they’re just looking for the best tool to keep them dry. Herein lies the opportunity for the entrepreneur.

Customers are predictably self-centered. Their mindset is “What’s in it for me?” They don’t care about the technology underlying a product or service. They simply want to get their Job done. To this extent, customers will simply “hire” the tool that delivers the greatest ROI against the Job.

The best Jobs for startups to solve—the Jobs that “household name” companies focus on—are the ones that are durable over time: Jobs that are done over and over across many different groups of people. In this sense, the JTBD framework is a fantastic tool for you as a founder to get to the core of the problem that customers need to solve and to avoid having your team caught up in the novel—yet ultimately superficial—features of a product. This clarity will focus your energy and resources toward building the exact solution that will lead to repeated usage and customer love. Now that you know that the Job is to stay dry, do you design an umbrella, a raincoat, waterproof shoes, or something else? While staying dry is a meaningful Job-to-Be-Done (especially in Seattle), some Jobs underpin large markets and beget compelling technological solutions that can lead to large outcomes. Here’s how we think about selecting a Job.

The best Jobs improve on behaviors that…

- Are done repeatedly: preparing a meal, commuting, communicating with colleagues, etc. vs. one-time events (leap-year trip planning, retiring, dying).*

- Are must-haves vs. nice-to-haves: transportation vs. decoration.

- Have a high return on investment: customers realize compelling results relative to the amount of time and/or money they’ve had to invest.

For a startup that has yet to catch lightning in a bottle (PMF), some common traps to avoid while selecting a Job include:

- Taking over multiple Jobs at once: A new customer usually has a single pain point when they first find you. If you force them to do more than they want to get started, you risk churn.

- Jack of all trades, master of none: Especially with a small team, trying to do many things means resources are spread thinly across Jobs. Your product ends up with a lot of functionality, but doesn’t do any one Job particularly well.

While this post is primarily focused on pre-PMF startups, there is one primary post-PMF trap we commonly see while expanding Job offerings:

Don’t bury your lead Job: because a customer is “hiring” your product to do a single Job, if your first-time user experience isn’t optimized for that Job, they may get confused and churn even if the functionality is there, but buried. This is why big companies have multiple apps (Uber and Uber Eats) instead of putting all functions into one: different Jobs to be done.

25 years later, Google search is still a testament to this philosophy. The user’s Job is simple: when you need to find something on the internet, you want to strike a few keys and get to the right page fast, so you can accomplish what you set out to. Google’s landing page is purpose-built for just that, and it’s why they have a different URL for their other Jobs, like maps.

Remember, customers will always seek out the single best tool for the Job.

Frame the JTBD through a Job Story

When it comes to lasering in on your company’s core value proposition, it’s helpful to use the Job Story language, originally popularized by Alan Klement. The Job Story language dials in on three key items: the triggering event or situation, the motivation/goal, and the intended outcome. A Job Story follows this format:

A good Job Story describes, with a high degree of precision, (1) the moment in which the customer faces the Job-to-Be-Done, (2) why they want to get that Job done, (3) and how completing the Job will make their life better—in other words, a Job Story is intended to precisely define the STORY of your customer’s Job, so that you can actionize the insight.

The Job Story describes the moment (imagine taking a snapshot of it) when the Job emerges. From there, you should be able to envision two futures unfolding—one with your product, and one without—to clarify what success looks like for getting the Job done.

Anchoring in our prior example:

When I’m walking over to a coffee meeting and it starts to rain, I want to find a way to stay dry while advancing to the destination, so I can make it to my meeting on time and still look professional.

Getting clear on this JTBD story can help you steer the product roadmap toward impactful refinements. In the scenario we laid out, if the tool you are designing is an umbrella, here’s one way to evaluate product improvements.

Product features that impact the Job

- Collapsible to fit in a bag (the best umbrella is the one you have on you)

- Strong spines so the umbrella doesn’t buckle with wind and get you wet

- Large circumference coverage when expanded

- Big, easily accessed button, for expansion under duress

- Lighter weight

Novel features

- Fancy prints and colors

- Handle material selection

The other benefit a clear Job Story has is clarifying the competitors you fight against when looking to get hired for the job. Depending on the situation, the umbrella competes with a raincoat and poncho, but might also compete with an Uber if you haven’t left for the coffee shop yet.

Let’s switch gears to something a bit more high-tech, like the brave new world of fintech. With technology solutions, often the Jobs are more nuanced. Let’s start by contrasting a bad JTBD story that makes it hard to see the nuance, with a good one that does.

Job Story A:

- When I’m using my checking account (too many different moments!)

- I want to have more money (er, don’t we all!?)

- So I can pay for stuff (too vague)

As opposed to…

Job Story B:

- When my checking account balance is running low and I see a big bill coming due

- I want to have my paycheck land in my bank account ASAP

- So I can initiate payment in time, avoid late fees, and feel less anxious

Can you see alternative futures unfolding better with Job Story B? We do. And so did a portfolio company of ours…

Now that you can see the Job Story, let’s actionize it:

Putting yourself in the shoes of a consumer, let’s look at Job Story B again:

- When my checking account balance is running low and I see a big bill coming due

- I want to see my paycheck land in my account ASAP

- So I can initiate payment on time, avoid late fees, and feel less anxious

Paying bills late not only creates anxiety but is also expensive. In 2020, Americans spent over $30 billion in overdraft fees and $11 billion in late fees. Surveys show that 1 in 4 Americans have no emergency fund whatsoever, and 50% have less than 3 months worth of savings. When an unexpected expense hits you (e.g., your water heater dies), your checking account balance is wiped clean and you face a common problem: you have bills due BEFORE the end of the month, and payday comes AT the END of the month. What do you do? Pay your bills on time and get hit with an overdraft fee, or pay your bills after payday and get hit with a late fee? Damned if you do, and damned if you don’t.

As a startup founder, what tool might you build to solve this Job?

A simplified set of choices might include:

- A product that gives customers a cash advance that’s cheaper than an overdraft charge

- A product that gives customers their paycheck up to 2 days early

- None—avoid building a tool to solve this Job altogether; the big banks have too much power

The nuances in the value propositions between Options 1 and 2 are critical when stacked against the Job Story. This difference in value prop, in fact, reflects the story of Menlo-backed portfolio company Chime, a company rethinking banking for the 21st century with a focus on protecting members and helping them reach financial security. Let’s dig a little deeper.

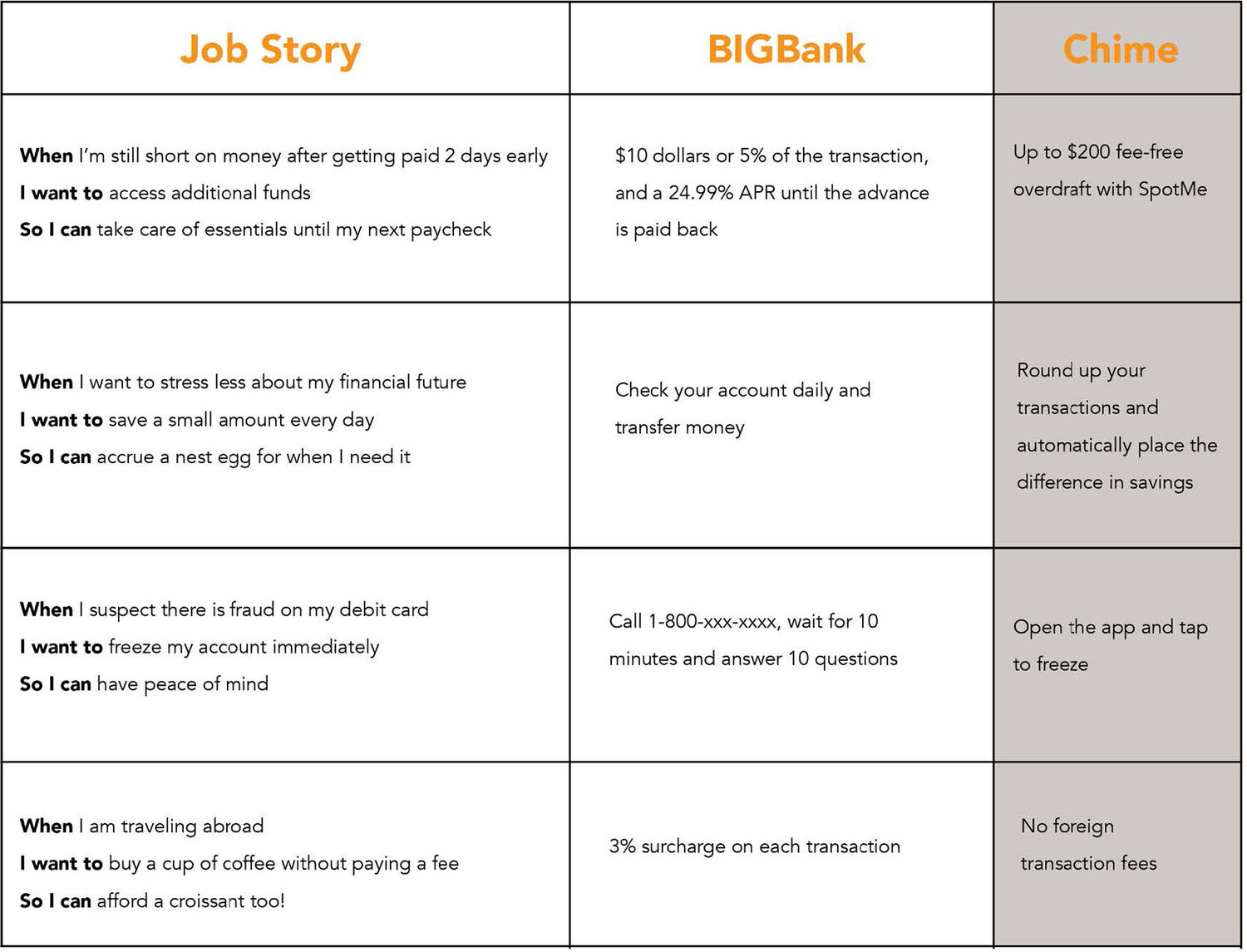

Chime vs. BIGBank

The first alternative to the late fee/overdraft fee scenario described above, Option 1, is to get a cash advance with any of the major banks. The fees incurred are $10 or 5% of the amount of each transaction, whichever is greater; using a credit card cash advance results in paying an APR that kicks in immediately.

The cash advance APR at most financial services institutions lands at 24.99%. Beyond the extra expense, customers suffer the cognitive load of doing the math.

Option 2, on the other hand—getting your paycheck up to 2 days early—is fee-free and has no other hidden caveats. Who wouldn’t want that? Here’s a deeper dive into several Jobs that relate to financial security, comparing Chime’s value prop with that of a typical BIGBank:

Framing the customer problem through the Job Story illuminates the value you need to deliver to seize the market

Laying out the Job Stories as related to financial security, as shown in these four examples, makes it easier to understand precisely what kind of value one would need to deliver on in order to offer a superior solution that wins people over.

As a founder, it’s dishearteningly easy to look at the big banks and say gosh, they’ve got millions of customers and tons of resources; I should avoid fintech altogether (Option 3 above). But when you break down financial security (resulting in greater savings and peace of mind) into its core Jobs—a set of Jobs faced by billions of people every day—you uncover meaningful problems in customers’ lives and can recognize that big banks aren’t addressing those problems well. From that understanding, you can start designing compelling solutions with precision, one at a time, just as Chime did.

Identifying the core Job-to-Be-Done and what it takes to create meaningful progress against it, building a product to squarely solve that Job, and executing that solution brilliantly is what separates consumer companies that catch lightning in a bottle from those that don’t.

Summary

Write a precise Jobs Story, rank value propositions against it, then build

In Chime’s case, here is our original Job Story example:

- When my checking account balance is running low and I see a big bill coming due

- I want to see my paycheck land in my account ASAP

- So I can initiate payment on time, avoid late fees, and feel less anxious

Which product do you build to win the customer over?

- A product that gives customers a cash advance that’s cheaper than an overdraft charge

- A product that gives customers their paycheck up to 2 days early

- None—avoid building a tool to solve this Job altogether; the big banks have too much power

Chime built a solution that helps customers get their regular paycheck up to 2 days sooner with direct deposit. Their root innovation was simple: generate revenue from debit card interchange fees (free to the consumer) instead of overdraft and account fees, realigning company and customer best interests. To generate meaningful interchange, Chime wants the full paycheck to land in the account, which also allows them to see the ‘signal’ that the funds are arriving 2 days before they clear, preventing fraud. Along with other beneficial features, like SpotMe, the average Chime customer saves hundreds of dollars per year by avoiding overdraft, minimum balance, and monthly service fees—all while steering clear of complicated paperwork, phone calls, or trips to a local branch. The whole system hangs together in a win-win for the customer and for Chime. And they’ve been rewarded for doing so.

By understanding laser-focusing on the Job at hand, Chime caught lightning in a bottle and has grown quickly over the past several years, most recently achieving a valuation of $25B. Chime has reached this stage by solving meaningful Jobs for over 12 million people, providing them with solutions that give them greater financial security. Now that is a mission worth fighting for.

Catching lightning in a bottle isn’t magic; identify the Job and focus intently on it

So did this post meet its JTBD? Let me know!

- When I’m a founder struggling to find product-market fit

- I want a quick yet substantial piece of advice that I can use in my next product meeting to steer our roadmap to success

- So I can make more customers happier, sooner

Better yet, what’s your Job Story? We’d love to hear it on Twitter @shawnvc

Check out our previous post on the MVP Tree to make sure the Job you’ve chosen to solve first aligns with a company mission that’s sufficiently motivating to devote the next 10 years of your life to.

Special thanks to my partner in crime Nihar Neelakanti for helping bring this thesis together and to the late Clay Christensen for gracing us with the wisdom and insight to make the world better, one startup at a time.

*There are certain events, like graduating college, getting married, etc., that, while not repeated often within one’s own lifetime, a person may repeatedly attend or may have meaningful dollar value attached (weddings, for example). These businesses that are event-based, however, can sometimes have network effects with the potential to build a large meaningful company. Zola is a prime example of a business that has both network effects and meaningful spend; while a wedding is typically a once-in-YOUR-lifetime event, you may attend multiple weddings in your life and spend meaningful $$ doing so.

As an early-stage investor, Shawn focuses on companies that serve the “utilitarian consumer”—the individual seeking better, faster, and cheaper ways to move through life. Because basic human needs are persistent, he looks at how people are spending their money and time to assess the value and utility of a product…