All Articles

PortfolioFunding

Menlo Ventures is excited to co-lead Lovable’s $330M Series B round with CapitalG and help Lovable enable the next generation of builders.

PerspectivePortfolio

2025: The State of Generative AI in the Enterprise

For all the fears of over-investment, AI is spreading across enterprises at a pace with no precedent in modern software history.

FundingPortfolio

Ushering in the New Guard of Vulnerability Management: Menlo Leads Zafran’s Series C

Zafran’s platform reimagines vulnerability management as an intelligent system that understands actual exploitability and takes autonomous action, consolidating what has historically been fragmented across…

PerspectivePortfolio

Agents for Security: Rethinking Security for the Age of Autonomy

With millions of unfilled positions and increasing threat volumes, cybersecurity is facing a scale challenge that only autonomous AI can solve.

PortfolioFunding

The Future of Music Is Participatory: Leading Suno’s Series C

Music has been a big part of my life. I started playing the piano when I was 4, classically trained, and performed internationally before…

PortfolioFunding

Investing in Agency’s Series A: The AI Operating System for Customer Relationships

Agency is positioning itself to become the system of record and intelligence layer for all customer interactions—from first touch to renewal and expansion.

PortfolioFunding

Q3 2025 Anthology Fund Update

We’re excited to announce that the Anthology Fund portfolio has now grown to 45+ companies with 12 new additions this quarter.

PortfolioFunding

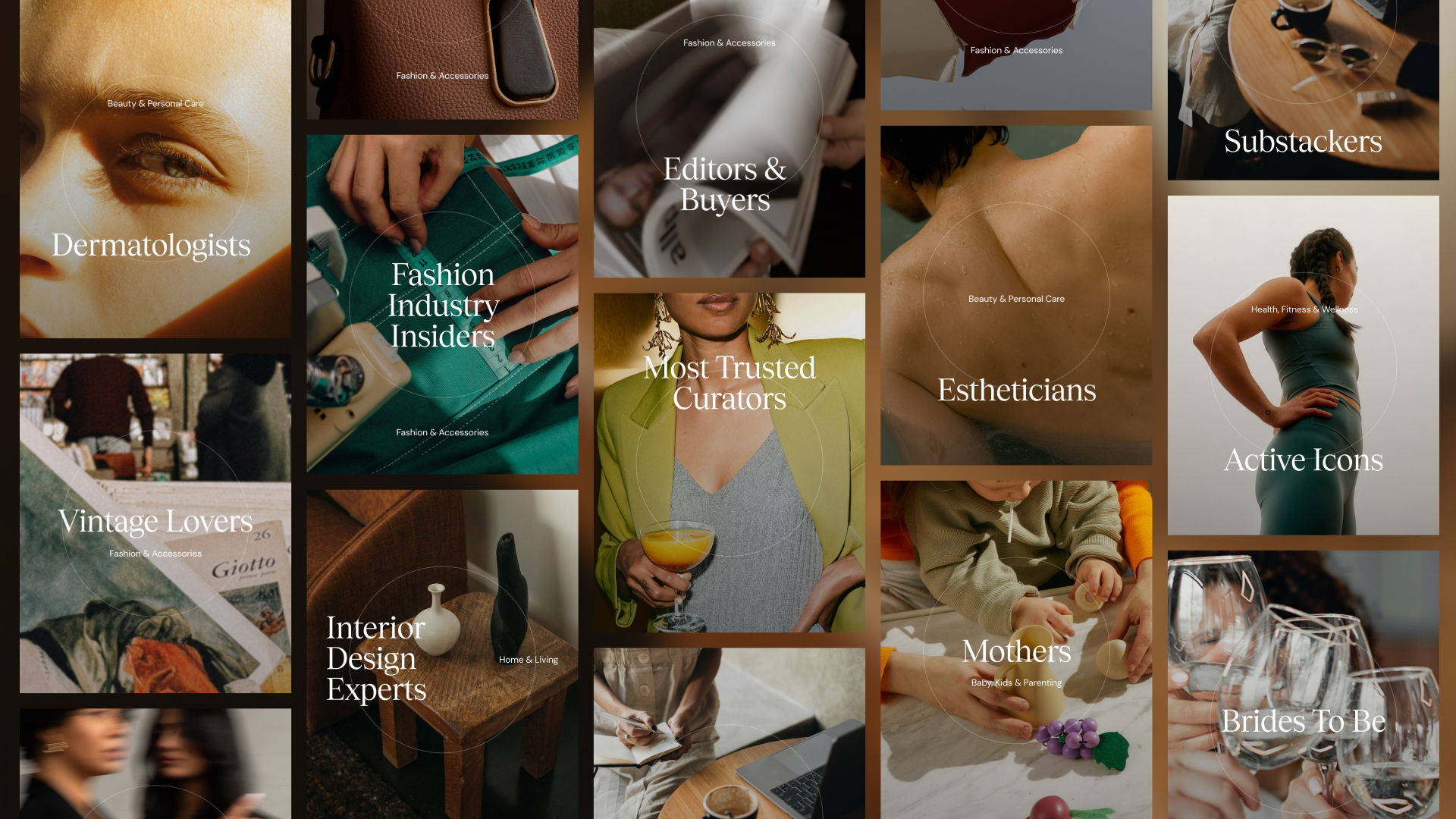

Doubling Down on Curated Commerce with ShopMy

We’re thrilled to announce that Menlo Ventures has doubled down on ShopMy in its latest $70 million raise at a $1.5 billion valuation to…

PerspectivePortfolio

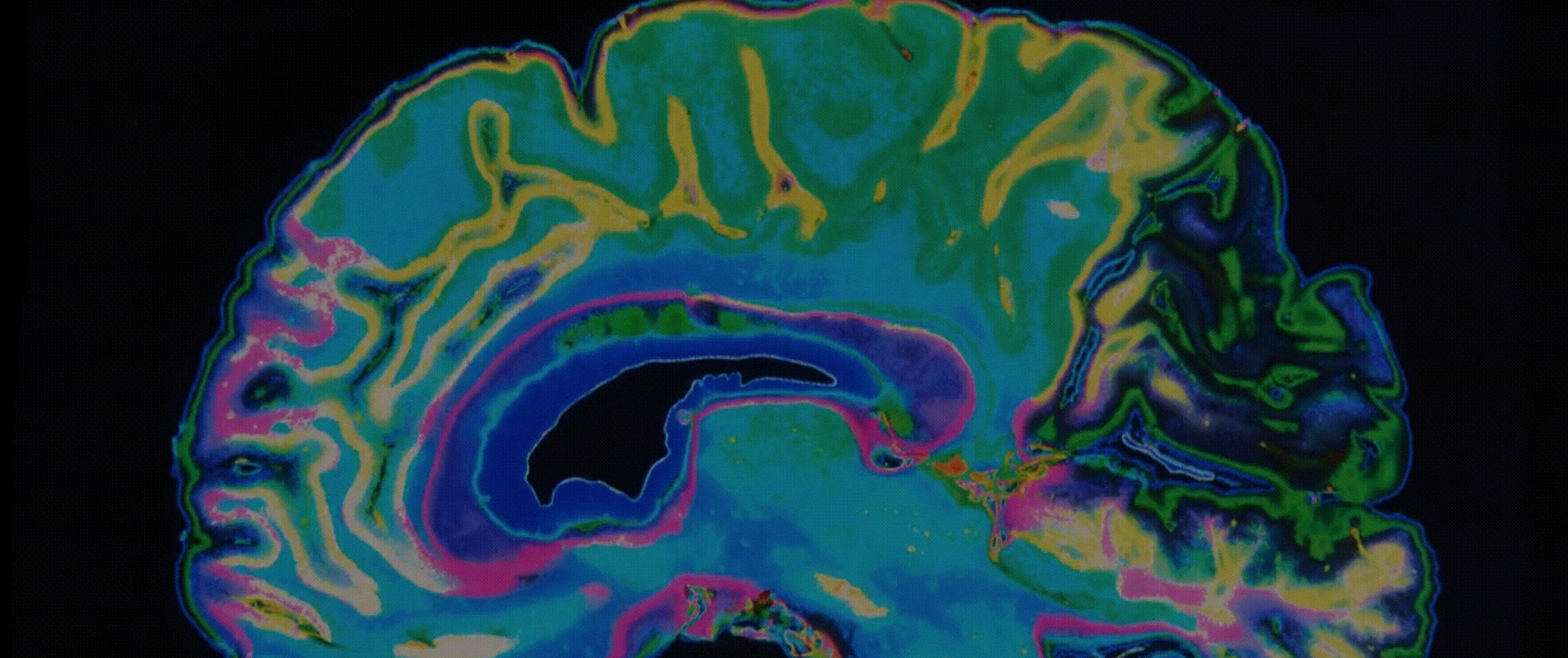

2025: The State of AI in Healthcare

Healthcare is setting the pace for enterprise AI adoption. Long dismissed as a digital laggard that trailed years behind every major innovation wave, healthcare…

FundingPortfolio

For the Love of the Developer: Announcing Clerk’s Series C

In application development, there are two universal truths: 1) Every application needs authentication, and 2) No developer wants to build authentication. Building customer-facing auth…

PortfolioFunding

Backing Trove AI: Agents for Private Equity

If you’ve worked in private equity, you know the drill: thousands of documents, scattered data, and a ticking clock to turn it all into…

Portfolio

Pioneering the UI for AI: Celebrating Sana’s Anticipated Acquisition by Workday

This is an important day for the team at Sana and Menlo as Workday has entered into a definitive agreement to acquire Sana.