The COVID-19 pandemic changed the world of benefits forever. Companies rethought the traditional office paradigm and re-evaluated the suite of benefits that provide a strong work experience for employees. While benefits were rapidly becoming a strategic category before COVID (especially for tech businesses), in the future, every large company across America will need to compete on the quality of their offerings. This adoption cycle presents an unprecedented opportunity for the next generation of benefits businesses to eclipse the $30 billion market cap of first-generation companies like Teladoc.

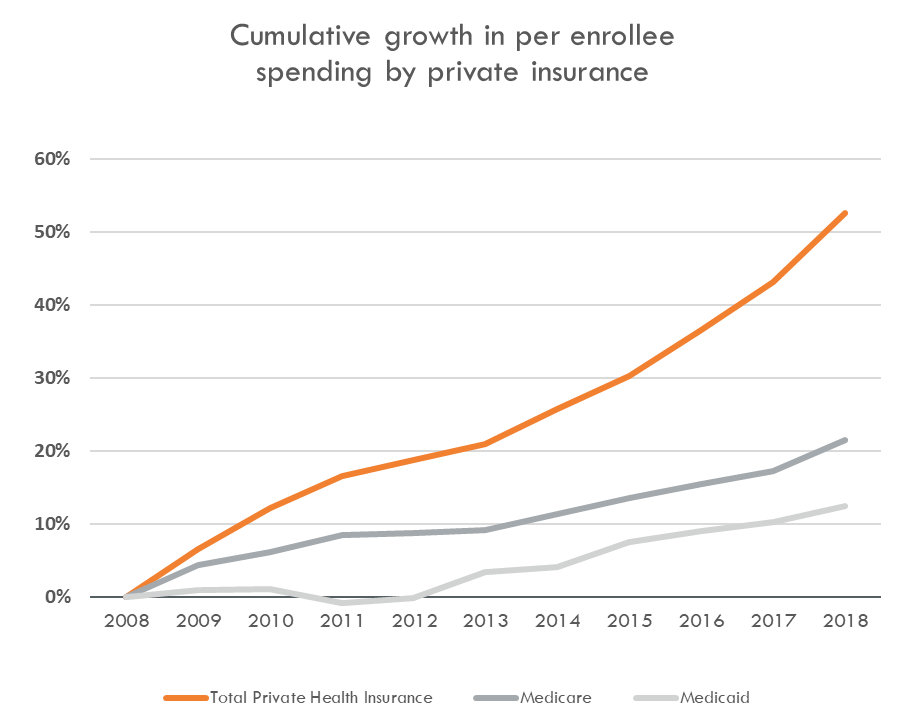

The U.S. benefits industry was born in 1942 after legislation designed to combat inflation limited wage increases for workers, incentivizing companies to compete on non-taxable health insurance benefits. In the 80 years since, the employer-sponsored healthcare industry has remained relatively consistent, with core medical, dental, and vision benefits provided to employees. Unfortunately, however, employers’ costs to provide these benefits have been increasing at a rapid clip. It has outpaced growth in government-sponsored healthcare spending, growing over 50% from 2008–2018.

Historically, benefits leaders were focused more on the administration of core benefits than on strategically designing a holistic plan for the employee base, but that is changing. According to Sequoia Benefits, 78% of companies now report informal or formal benefits strategies. There are more dollars than ever available to companies selling employee benefits; however, at the same time, companies are more strategic and rigorous in evaluating offerings.

At the highest level, benefits leaders purchase technology because they believe the solution will deliver ROI by creating savings in their health plan, or because the offering will make them more competitive in attracting or retaining employees. While many solutions accomplish both goals, I’ve labeled what I believe to be the primary value proposition of each category in the market map below.

Many early successes in the benefits space focused on ROI by bringing costs under control in the core plan. Teladoc, founded in 2002, convinced employers of the ROI that could be had by making telemedicine available at lower costs to employees than in-person visits and the benefits of managing conditions early. Livongo built upon that trend by identifying that employees with chronic diseases (such as diabetes) drove a significant portion of self-insured costs, and managing those populations would deliver substantial returns.

The next generation of ROI-based businesses poised to create significant value are emerging in the musculoskeletal area (such as SWORD or Hinge), flexible dental/vision plans (like Level Benefits or Beam Dental), care navigation (companies like Rightway, Nayya, Eden, or Amino Health), and DE&I analytics (such as Syndio). Perhaps most importantly, innovations in the core medical plan are long overdue, and companies like Sidecar Health have the potential to dramatically cut costs for employers by providing transparency and incentives to employees in a cash-pay system.

While ROI will continue to be a core driver of purchase decisions, the need to provide competitive benefits has also increased in importance. Especially in highly competitive industries such as technology (where companies compete against the unlimited budgets of Google, Amazon, and Facebook), certain benefits rapidly become table stakes to attract and retain employees. At the top of that list are mental health benefits, where providing options for employees to address all aspects of mental health is a strong signal that an employer values their workers.

Similarly, employees view coaching solutions and financial wellness providers as an investment in their development and an incentive to stick around for longer. Benefits leaders focus on solutions that will either help broad swaths of the population (mental health) or have a life-changing impact for narrower but highly strategic employees (such as Maven Clinic or Wellthy). Again, with all of these companies, the value proposition is two-fold, as when a platform helps employees return or increase focus on work, the business realizes significant ROI. However, as it may be hard to quantify payback in the short term, the competitive dynamic becomes an essential driver of purchase behavior.

The world of selling to benefits is complex, and start-ups may not scale rapidly initially, as they seek to convince the market of their value proposition. Brokers play a critical role in the benefits market, and it takes some time to activate the channel and go through sufficient enrollment cycles to hone go-to-market strategies. While the benefits sector is not without its challenges, companies that crack the code have the potential to become enormously important in an era in which employee benefits are more critical than ever.

Steve is a partner at Menlo focused on investments in Menlo’s Inflection Fund, which targets fast-growing Series B/C companies. He specializes in AI-powered vertical SaaS investments and supply chain technology, including Enable, Eleos, Observe.AI, Scout, 6 River Systems, ShipBob, CloudTrucks, and Parade. Steve joined the firm in 2015 as an…