Economic downturns force us to get back to basics: The cost of new capital and low valuation multiples—even for top-performing public companies—force startups to make substantial progress per dollar to get a term sheet, much less an up round. The environment sharpens the focus on first principles like efficient revenue growth, strong customer retention, and high contribution margins.

It can be particularly challenging for B2C startups: When consumer spending contracts, it’s an uphill battle to win new customers. Companies that thrive in these harsh conditions learn early that they need to be laser-focused on a customer pain point and drive hard, attributable ROI. Consumer companies built during bear markets don’t have the luxury of slow and expensive experimenting, and must be disciplined to achieve stellar outcomes.

Yet, history tells us that incredible companies can emerge in a down market. We know this to be true: Menlo invested early in several notable recession-born babies that became household names, including Roku, Uber, and Siri (and worth adding that my colleague, Venky, backed Redfin in his previous role, while Matt backed Shazam prior to joining Menlo). In fact, when we reviewed a list of the last decade’s largest 100 consumer exits,1 we found that 30% were founded during the 2000-2002 and 2007-2009 bear market cycles.

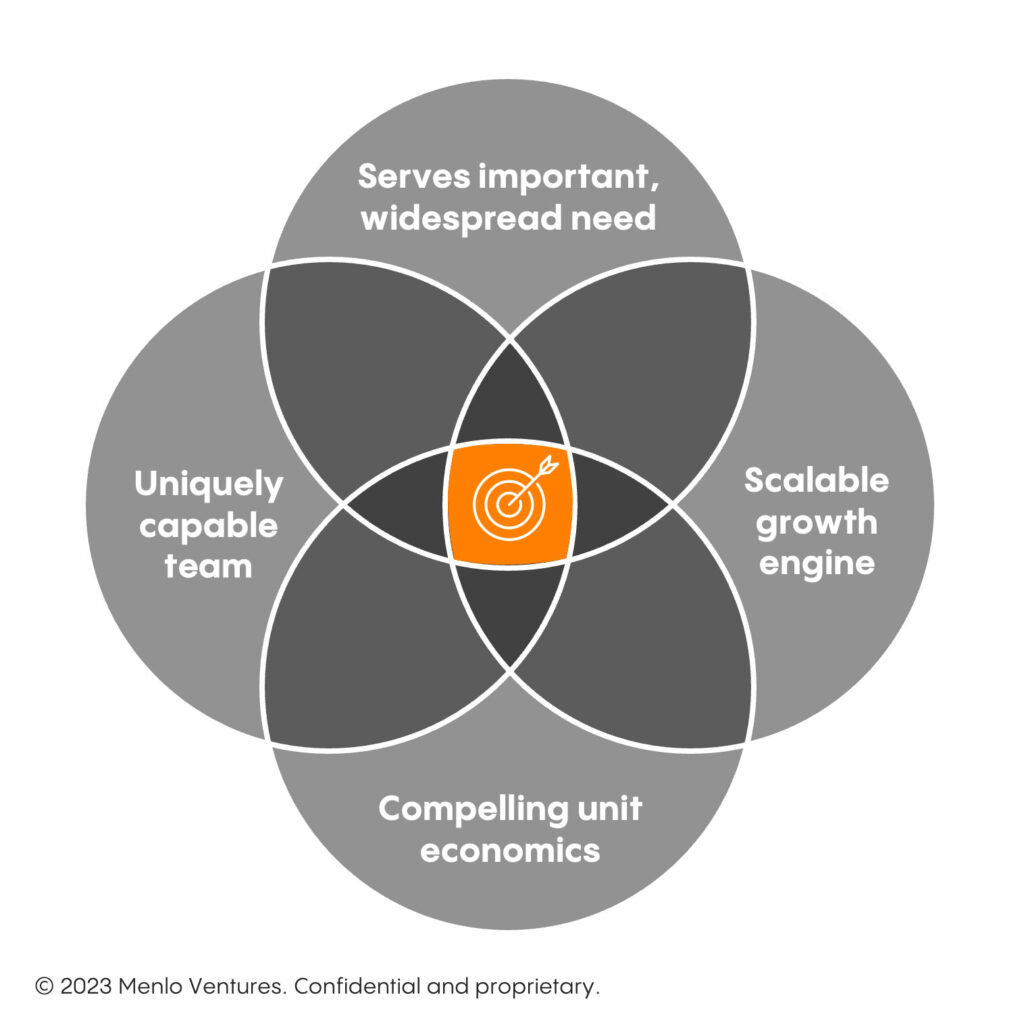

If you’re founding a consumer business in the current economic climate, you’ll face hurdles—but not insurmountable ones. Embrace the opportunity to do something big, but build on a strong foundation. From starting to scaling, these four fundamental principles are now more important than ever:

- Identify a widespread need

- Recruit a uniquely capable team

- Grow with a repeatable, scalable growth engine

- Monetize with compelling unit economics

1. Identify a widespread need

In the early ideation phase of a business, focus on ideas with a massive potential market. To pinpoint widespread needs that create a large potential customer base for a new product, consider typical “jobs to be done.” Though life has changed drastically over the years, consumers’ needs remain largely fixed—as do the daily “jobs” we tackle: putting food on the table, commuting to work, shopping for necessities, putting money in the bank, finding healthcare, etc.—the list goes on. Companies provide value when they help consumers get jobs done better, faster, or cheaper.

Founders (this is important): New solutions to old problems should not be overlooked! Advancements in technology create opportunities to solve old jobs better, as do regulatory changes and social/demographic shifts. As an example, I’d point to Uber’s innovative take on the fundamental job of transportation—a daily task for many of us. Before Uber, we could solve transportation needs with public transportation, taxis, or our own vehicles (and feet!). Uber created a massive and innovative business by solving an age-old problem. They leveraged the smartphones that were suddenly in everybody’s pockets and a brilliant combination of newer technologies like mobile payments and GPS. They delighted customers with a significantly better/faster/cheaper transportation experience, quickly eating into the massive transportation market.

Platform shifts are powerful ingredients for innovation, but to make a lasting impact, founders must stay diligently rooted in fundamental consumer jobs to be done. For example, the shift to mobile GPS-aware apps in your pocket was a powerful replatforming that Uber capitalized on to improve transportation. On the other hand, crypto achieved significant hype in 2021, but their focus on currency speculation instead of utility led to a massive contraction in the downturn. We are optimistic about the capabilities of generative AI, specifically large language models and image generation models, and we’re looking forward to partnering with founders capitalizing on this new technology platform to transform how consumer jobs are done.

2. Recruit a uniquely capable team

Building a startup is a team sport and the team is critical. You should ask yourself: Do you have the right team to solve this problem? What are the key attributes of your founding team that makes you uniquely suited to solve the problem at hand? Depending on the market, it might be your deep technical expertise, proprietary insights, or unparalleled domain experience.

Flashback to Menlo’s early investment in Siri: The unique qualifications of the team drove our decision. There was only one team that combined the business acumen, technical chops, and commercial instincts required to take a voice assistant mainstream. The team that spun out of SRI was well-suited to the challenge. As entrepreneur-in-residence at SRI, Dag Kittlaus (who also co-founded Menlo portfolio company Riva) saw the huge commercial potential of the voice assistant technology being developed and applied his business acumen to the technical problem as Siri’s CEO. Technical co-founders Adam Cheyer and Tom Gruber complemented Kittlaus, sharing his strong vision for a future made more productive by AI assistants, while bringing the technical prowess and domain expertise to bring the vision to fruition.

An ability to attract and retain talent is also critical. Building a durable business requires a variety of skills; no founder ticks every box. Great founders are self-aware and recognize which complementary skillsets they need on their team. They try to hire best-in-the-industry talent that spikes in these areas. The economic downturn provides a tailwind here—following the recent tech layoffs, there is much more high-powered talent available to work on next-gen solutions.

3. Grow with a repeatable, scalable growth engine

You’ll need to create a powerful customer acquisition flywheel to drive rapid and sustained growth. In consumer markets, there are only a few options that scale past $100 million in revenue: 1. k>1 virality or 2. cost-effective paid acquisition. Virality is always preferred (it’s free!), but very few products have the natural network effects or sufficiently high word-of-mouth to spark exponential growth. The next option is building awareness through efficient and scalable marketing, creating a funnel that is continuously optimized to drive inexpensive customer conversion and retention. The highest performing funnels capitalize on their virality or spend with great first-time user experiences that explain the value proposition clearly and drive quickly to solve the job, i.e., a short “time to wow.”

Our portfolio company Photomath’s savvy freemium strategy created a cost-effective customer acquisition funnel. Photomath offers an incredible study tool that helps people understand how to solve math problems; users simply take a picture of the problem with their phone to receive step-by-step instructions on how to solve it. Any parent who ever struggled to help a frustrated high schooler with math understands that helping with homework is a painful job to be done. The team didn’t spend any money on advertising, betting on the “wow” factor to generate organic growth within tight communities of students, parents, and teachers. The app sold itself, wowing users with instant solutions to scanned math problems. (And, likely measurable ROI in reduced parent/child conflict per homework session!) By placing detailed explanations for their solutions behind a paywall, they were able to convince a large portion of free users to convert to subscribers. Not surprising when you compare the high cost of hourly tutors versus the affordability and convenience of Photomath!

4. Monetize with compelling unit economics

- LTV/CAC Ratio: The “V” in an “LTV” (lifetime value) equation is a math problem that relies on contribution margin, not gross revenue. This makes intuitive sense: If a company is to model the magic LTV/CAC ratio of 3:1 or higher over three years, they must generate real margins. LTV/CAC tells you how much cash is generated per customer to hire engineers, designers, and the rest of the product delivery engine.

- CAC Payback Period: How long does it take to generate enough contribution margin to pay back the full sales and marketing spend of a given month? The payback period determines how long your capital is tied up in growth. It’s a key measure of efficiency in your GTM engine.

Chime exemplifies the compelling unit economics that facilitate efficient growth. On the cost side, variable transaction costs, fraud losses, and customer service costs remain consistent and manageable, while effective paid and viral marketing drives down their CAC. Their margins continue to improve; as they have scaled, they’ve negotiated volume discounts with card and banking service providers. In terms of LTV, strong customer retention is built into the product as customers direct their paycheck to Chime, and customer obsession has been a #1 priority from the start. It’s hard to believe that a financial institution could inspire so much customer love, but Chime has done just that. See for yourself with the compilation of customer testimonials below.

Caveat: There’s a reason this fundamental comes last. Sometimes—ahem, Uber—it makes sense for a business to take a hit on unit economics to go after massive market share. Companies like Uber and Instacart burned through a lot of capital to introduce customers to their services. Over time, as awareness and use of their services grew, they improved their economics. It’s not surprising! For many of us, we took our first Uber or had our groceries delivered once and we never looked back! Founders, be careful with this one: You’ll need a good story about the long-term model to convince investors there are profits in your future.

Let’s be honest. There’s never a perfect time for starting a business. Bull or bear market, challenges and risks are always part of the equation. But if you want your breakthrough idea to break out, it must be built on a foundation of fundamentals.

If you are a founder building a company that consumers will love, we want to hear from you. Come prepared to share your fundamentals. We’ll kick the tires and do our diligence because we can only invest if we believe you’ve got a firm handle on the fundamentals. We’re not a particularly flashy firm, and we’re okay with that. We don’t chase fads or “go on gut.” We work to resist FOMO, and we don’t feel the need to invest in every shiny new object. We simply want to back great teams building incredible businesses on solid foundations. If that’s you, let’s get going.

- Proprietary data.

As an early-stage investor, Shawn focuses on companies that serve the “utilitarian consumer”—the individual seeking better, faster, and cheaper ways to move through life. Because basic human needs are persistent, he looks at how people are spending their money and time to assess the value and utility of a product…