This post originally appeared in siliconindia.

Cloud, data analytics, and mobility are fundamental venture trends that will continue to offer incredible investment opportunities for venture capitalists. The recent disclosure by Amazon that AWS is now a $6 billion business is validation that the move to the cloud is not a fad but a fundamental reshaping of the enterprise architecture. At Menlo we have been big believers in these trends. Companies such as Carbonite (cloud backup), BeyondCore (data analytics), and Uber (mobile) are wonderful examples of game changing companies innovating in these spaces. The biggest challenge we face as an industry is how crowded these spaces are getting, and with a great amount of funding going into a number of companies in each area has resulted in a sub-optimal outcome for all.

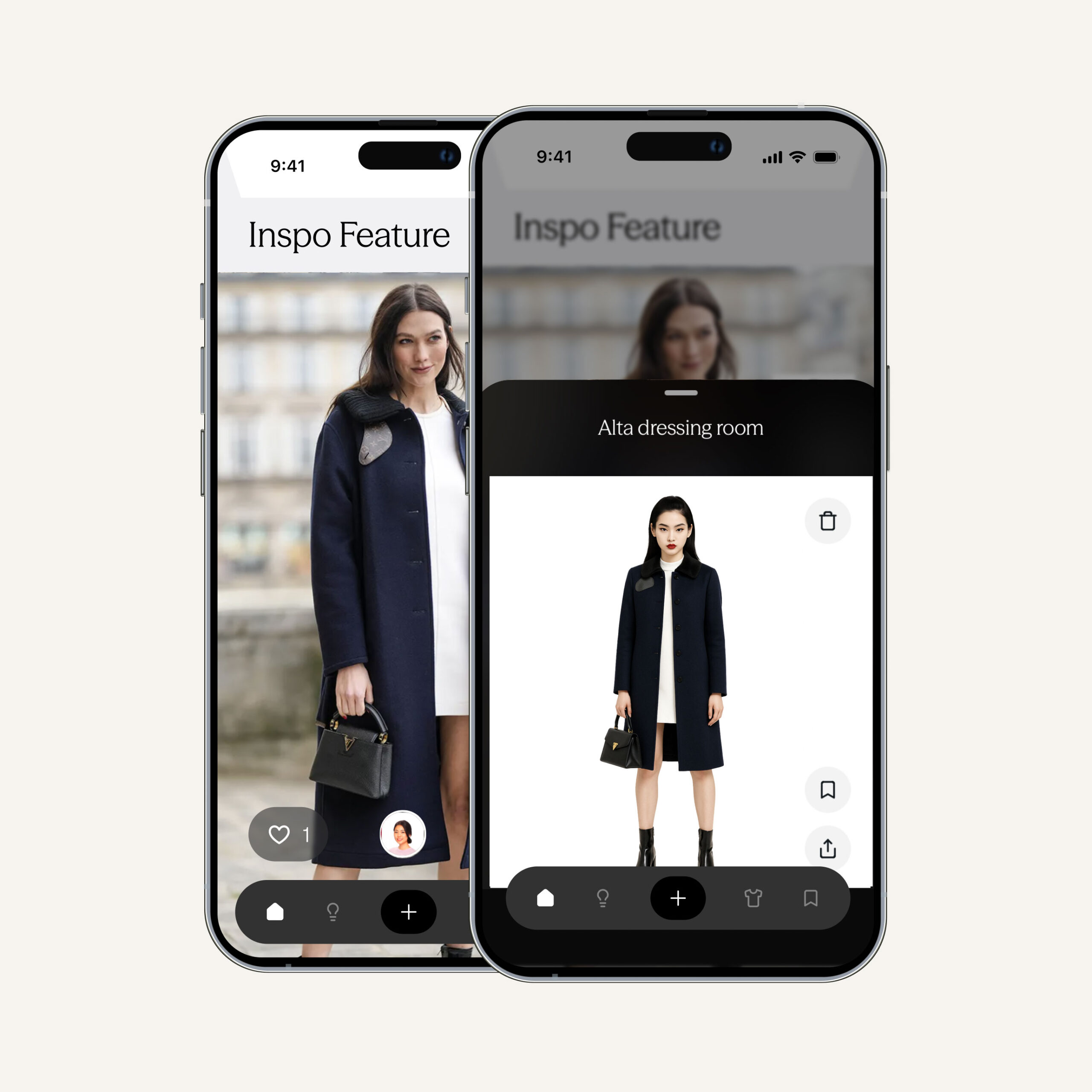

One of the hottest technology sectors today goes by many names: the Sharing Economy, Collaborative Consumption, Freelance Nation, 1099 Economy, the Right Now Economy, and simply “Uber for Everything.” At Menlo, we are continuing to place big bets on marketplaces as the sector evolves exponentially. Beginning with transportation and travel, marketplaces are now upending even more establishment industries like wealth management and real estate investing, health insurance, and education. Companies that lay the groundwork in the early stages by measuring their full sales funnels (not just successes and failures) are able to attain real traction and revenue growth. Good examples of companies leading this trend are Munchery (restaurant), Betterment (wealth management), RealtyShares (real estate investing), Poshmark (fashion e-commerce). We believe that every category on Craigslist today will break apart into a vertical marketplace in the future.

The security space no doubt has been a devil’s playground. There are always opportunities for innovation, especially in cybersecurity and it has been the fastest growing sector in all of technology today. By some estimates, 80 companies are funded by investors per month to go after this market. And for good reason: while $70 billion is spent per year on information security, this is still less than 5% of total IT budgets for large enterprises. In addition, security issues are widespread across all industries—not just financial institutions and governments, but retail institutions, healthcare companies, and even the movie industry need protection. Hackers aren’t specifically targeting certain companies anymore, but are algorithmically using computers in an undifferentiated way to scan for vulnerabilities across the board. Even the smallest companies need security infrastructure. Because of this, Menlo is dedicating 20% of our current $400 million fund to cybersecurity innovation. Particular areas we find interesting in cyber security include breach analytics, mobile security, endpoint protection and social media.

Follow the Fundamentals

The biggest challenge entrepreneurs face today is distraction and noise on company financings. There is too much focus today on the balance sheet (valuations, dollars raised, etc.) and not enough focus on the income statement (revenues, expenses, profit). Long-term value creation is done not by raising money from investors but by getting purchase orders from customers. We are in a unique time in history where the combination of cloud, mobile, social, and big data is enabling a tremendous opportunity to create game changing companies. Focus your energies on a big problem, solve it with great technology and validate your progress with revenues. If you do that, good things will follow. Follow the fundamentals and not the fads and your future is going to be bright.

Venky is a partner at Menlo Ventures focused on investments in both the consumer and enterprise sectors. He currently serves on the boards of Abnormal Security, Aisera, Appdome, BitSight, Breather, Dedrone, MealPal, Rover, Sonrai Security, StackRox, and Unravel Data. Prior to joining Menlo, he was a managing partner at Globespan…