A year after launching our Anthology Fund, a $100M initiative in partnership with Anthropic, we’re excited to share a Q2 2025 update on our progress.

Anthropic has become the fastest-growing software company in history. In just three years, the company has grown from $0 to $100M in 2023, $100M to $1B in 2024, and now from $1B to nearly $5B, blowing past even the most bullish expectations.

The majority of this spend is coming from innovators building on Claude. According to Menlo’s Mid-Year LLM Market Update, enterprise LLM spend more than doubled in the first half of 2025, exceeding $8.4B.

With the Anthology Fund, we’re backing the most promising AI-native teams at the earliest stages, helping them go further and faster with deep support from both Menlo and Anthropic.

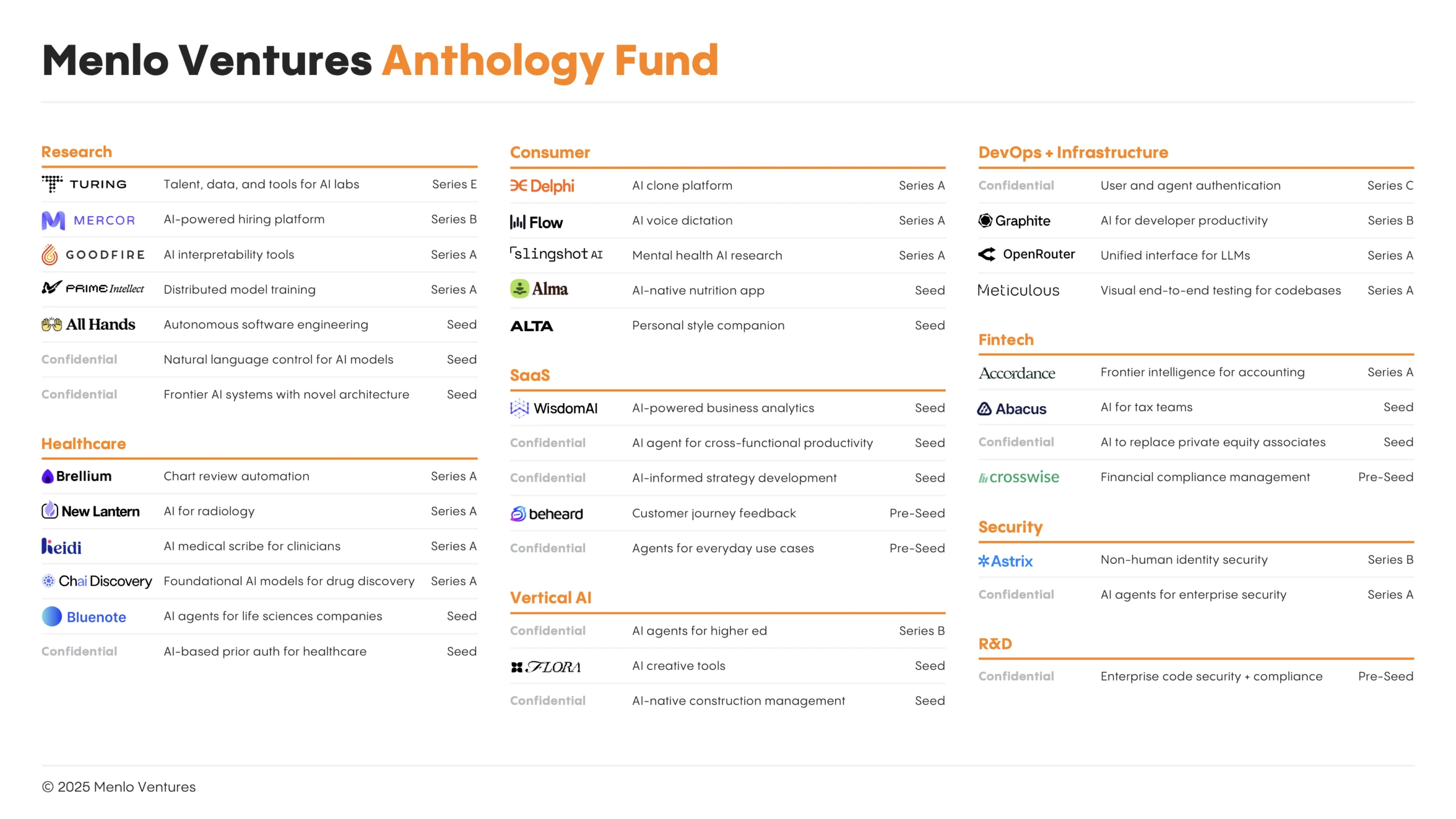

The Anthology Portfolio

In just one year, we’ve partnered with more than 30 Anthology companies, with several already graduating from seed to lead-stage investments.

In Q2, we doubled down and/or led rounds in:

- Goodfire – AI interpretability tools;

- OpenRouter – unified interface for LLMs;

- Wispr Flow – AI voice dictation;

- and more unannounced.

We also invested in six other companies this quarter, including (with more to be announced soon):

- Abacus – AI for tax teams;

- Turing – talent, data, and tools for AI labs; and

- Chai Discovery – foundational AI models for drug discovery.

What We Invest In

The goal of the Anthology Fund is simple—back the most promising AI-native teams through three core types of bets:

- First investment (Pre-Seed) for incredibly talented founders building in AI.

- Lead or smaller supporting check for Seed/Series A companies.

- Supporting investments in companies with strategic benefit to Anthropic.

In the case of a smaller initial investment, we usually aim to lead the next round as the company proves product-market fit and breakout. We do not require companies to use or be built on Anthropic, as long as there is some key alignment with Anthropic and how we believe the AI ecosystem will grow.

Why Be a Part of Anthology?

Anthology company founders are part of a community and gain a rare advantage via:

- Deep connectivity with Anthropic to understand where the puck is headed in AI;

- Access to resources like $30K in Anthropic credits and $100K in AWS credits;

- Invitation-only events with Anthropic’s technical leaders that go deep on what to build, why it matters, and how to think about AI development.

And, more than anything, being a part of a trusted community of peers working on similar challenges, sharing insights, and learning from one another as the pace of innovation accelerates.

On Deck for Q3

In Q2, we hosted an Anthology Founder Day at Anthropic HQ—a half-day of technical talks led by the Anthropic team, agent demos, and connections between founders.

In Q3, we expect to keep the momentum going with:

- More Anthology Fund events, including another Founder Day with Anthropic.

- More technical partnerships with Anthropic.

- More founder-to-founder connections.

- More iconic AI companies.

The next era of AI is being shaped in real time, and we’re proud to be partnering with the visionaries using Anthropic to push the frontiers of AI. Let’s build!

As always, you can apply to Anthology here or reach out to us directly.

The Anthology Fund is a groundbreaking $100 million initiative created through a partnership between Menlo Ventures and Anthropic. The fund was created to fuel the next generation of AI startups through the powerful combination of Menlo’s extensive company-building experience and Anthropic’s pioneering AI technology and deep research expertise. Through this collaboration, we aim to catalyze innovation and shape the future of artificial intelligence in the startup ecosystem.

Tim is a partner at Menlo Ventures focused on early-stage investments that speak to his passion for AI/ML, the new data stack, and the next-generation cloud. His background as a technology builder, buyer, and seller informs his investments in companies like Pinecone, Neon (acquired by Databricks), Edge Delta, JuliaHub, TruEra…

Deedy is a partner at Menlo Ventures focused on early-stage investments in AI/ML, next-generation infrastructure, and enterprise software. Having been an engineer and product leader at both a successful startup and large public companies, Deedy is well-equipped to help technical founders navigate how to build and scale enduring tech companies.…

Matt is a partner at Menlo Ventures and invests multi-stage across AI infrastructure (DevOps, data stack, middleware, API platforms), AI-first SaaS (vertical and horizontal), and robotics. Since joining Menlo in 2015, Matt has led active investments in Anthropic, Alloy.AI, Benchling, Canvas, Clarifai, Carta, Envoy, Harness, HOVER, Mimic, Netlify, Observable, OpenRouter,…

As a principal at Menlo Ventures, Derek focuses on early-stage investments across AI, cloud infrastructure, and digital health. He partners with companies from seed through inflection, including Anthropic, Eve, Neon, and Unstructured. Derek joined Menlo from Bain & Company, where he advised technology investors on opportunities ranging from machine learning…

A self-described “tall, slightly nerdy product guy,” Joff was previously the Chief Product Officer of Atlassian, responsible for leading its acclaimed portfolio of products, including Jira, Confluence, and Trello. During that time, Joff was named on the “Global CPO 20” list by Products That Count and as a “Top 20…