History may not repeat itself, but it often rhymes.

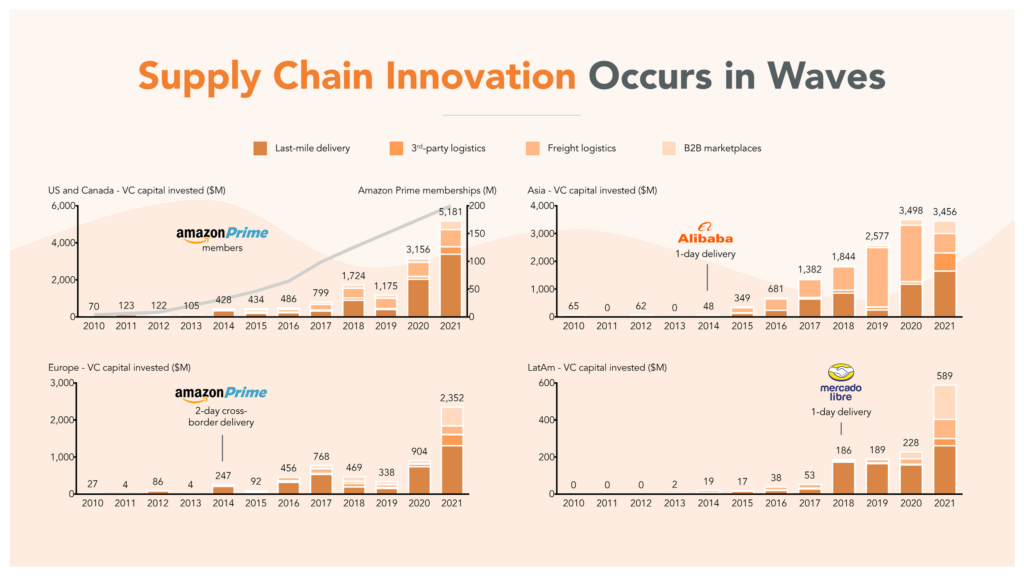

And so it has in the patterns of new technology and business model development that have powered the past decade’s advancements in supply chain digitization around the world—first in the U.S., then Europe and Asia.

Across each of these global markets, an initial inflection in e-commerce penetration and heightened consumer expectations for fast, free delivery has served as a “Cambrian moment”—a catalyst for technological innovation—in the evolution of the region’s logistics infrastructure.

A dominant e-commerce retailer—Amazon in the U.S. and Europe, Alibaba in China and Southeast Asia, Flipkart in India—provides the initial disruption. They introduce free same- and next-day delivery, permanently raising the bar for what consumers would demand in convenience and speed in online purchasing, and pressuring other retailers to match their capabilities.

An explosion of new startups then rush in to help these legacy players compete, catalyzing waves of logistics innovation that ripple backward across the supply chain.

First, it’s last-mile logistics, then 3PL, followed by freight brokerage and forwarding. Eventually, digitization reaches even B2B marketplaces as small business owners and enterprise procurement leaders start to demand the same Amazon-like efficiency and clarity for their business purchasing as their personal buying.

These successive patterns of innovation are readily seen in the increases in venture funding for each category of supply chain technologies in the years following the initial catalyst:

Over the past decade, these forces have again and again produced scaled outcomes around the world. Now, it’s Latin America’s turn.

Latin America’s Cambrian Moment

Mercado Libre, LatAm’s largest e-commerce platform, launched its same-day delivery network in 2018. As in other regions, early-stage investments in last-mile delivery then scaled in rapid succession—quickly minting 10 supply chain unicorns.

During the boom times of the pandemic, last-mile delivery providers like iFood, Rappi, and Loggi each raised hundreds of millions of dollars at billion-dollar-plus valuations from international investors. These funding rounds helped make Latin America’s startup market the hottest in the world only a year ago.

But amid today’s global macroeconomic reset, the golden era of low interest rates, abundant capital, and the late-stage mega-rounds they invited appears to be over. The top-line funding figures tell an easy story of foreign capital retreating back to their home markets, and headlines are wondering out loud whether the slowdown will beget a years-long slowdown in the digitization of the region’s economy and supply chain infrastructure.

Despite today’s broad capital outflows, there is reason for optimism that the experience of the past few years have been a crucible moment for innovation in LatAm supply chains, rather than a false start.

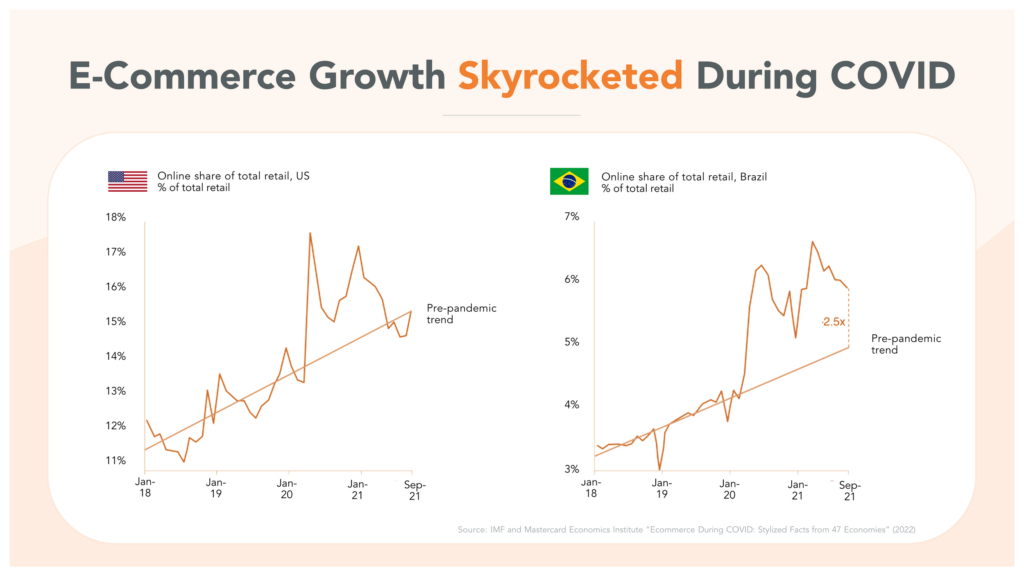

Secular tailwinds. Like in the U.S., e-commerce penetration spiked during the pandemic in LatAm—packing over four years’ worth of growth into the last two years as stay-at-home orders across the region led consumers to order many of the things they’d typically buy offline via online retailers. Unlike in the U.S., however, the region’s pandemic-fueled digital gains have persisted rather than returned to historic trend lines as COVID-19 has receded.

The stickiness of Latin America’s new digital consumption patterns can likely be attributed to the secular tailwinds supporting the region’s digital transformation—one that is enduring even amid the post-pandemic hangover in capital markets.

LatAm is home to a young and growing population that is currently twice the size of that in the United States. Internet penetration is at 78% overall, already greater than that in China (69%) or India (47%). And as this new generation of digital-native consumers grow accustomed to the modern conveniences of online shopping, the demand-side pull for more efficient, modern supply chains to deliver these experiences will only increase in the years ahead.

Unprecedented local talent. The patterns of supply chain innovation we’ve observed across the U.S., Europe, and Asia are not only a demand-side story—it is also an incredible tale of human capital accumulation and the construction of vibrant local startup ecosystems built on the success of their earliest outcomes.

For instance, LatAm’s supply chain technology ecosystem is already reaping the rewards of its pandemic-era exits: The liquidity generated is now being recycled into a second generation of more experienced, battle-hardened founders, many of whom were early employees at or otherwise closely connected with the first generation of companies.

ALLVP mapped out five of these Latin American “mafias”—named after their Silicon Valley godfathers, the original “PayPal mafia” whose members went on to launch Tesla, SpaceX, Netflix, LinkedIn, Yelp, Pinterest, and others.

The Rappi network is perhaps the most prominent example: Alumni and close associates of the last-mile delivery giant have launched over 100 startups. Fabián Gómez Gutiérrez, the founder of restaurant operating system solution Frubana, was an early employee at Rappi, as was Ángela Acosta, the founder of Morado. Enrique Villamarín, co-founder of Tul, is the brother of Rappi co-founder Felipe Villamarín and another Rappi network-backed founder. Jose Bonilla, the founder of Chiper, started the accelerator Imaginamos that spun out Rappi.

A well-understood playbook. Today’s LatAm founders are well aware of the patterns of supply chain innovation that have occurred in other geographies, and are actively learning from their predecessors’ playbooks—both what worked and what didn’t.

Many B2B marketplace founders, for instance, cite the Indian online wholesale platform Udaan as an example of what has worked. Operating in a developing economy with high fragmentation and low trust familiar to many Latin American founders, Udaan connects traditionally offline mom-and-pop retailers with wholesalers and traders to digitize the otherwise painfully laborious process of inventory procurement. The company was last valued at $3 billion.

On the flip side, founders are also acutely aware of what hasn’t worked. Brazilian restaurant procurement provider Cayena is seeking to overcome the shortcomings of previous restaurant direct procurement vendors by owning—rather than just digitizing—their customers’ transactions.

The software provider is doing this in Latin America by providing crucial value-added benefits, starting with price transparency in a fragmented food procurement supply chain, but also including digital workflow and working capital solutions.

The Opportunity Today

At Menlo Ventures, we’ve seen the successive waves of supply chain innovation ripple through the U.S., Europe, and Asia over the past decade. During this time, we’ve invested in several logistics leaders across the value chain—including ShipBob, Enable, Parade, and CloudTrucks.

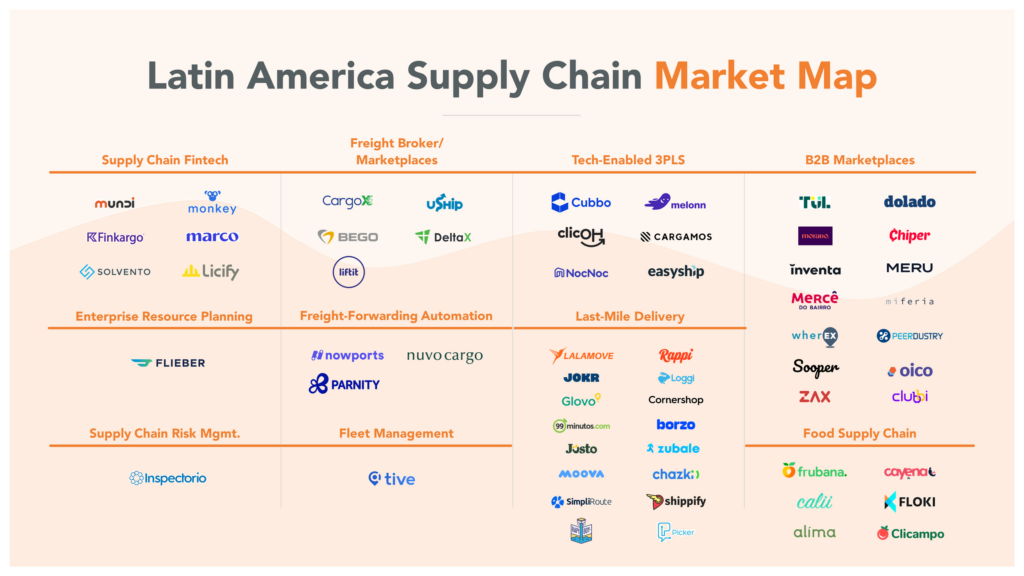

Now, that innovation has reached Latin America—starting with the last mile. Based on our experience in other regions and numerous conversations with local investors and leading early-stage companies in Latin America over the last few months, we believe the next three most immediate opportunities will be in tech-enabled 3PLS, B2B marketplaces, and food supply chain.

Tech-enabled 3PLS. On the tails of a booming demand for e-commerce from consumers, fulfillment has become a major need for both small e-commerce brands and large enterprises and marketplaces.

Dozens of 3PLS players are tackling this opportunity today. Business models in this space are often asset-heavy as startups seek to increase convenience for retail customers and logistics speed and experience for end consumers. Like ShipBob in the U.S., Latin American 3PLS leaders like Cubbo, Melonn, and ClicOH integrate the entire shipping process, from picking and packing to warehousing and delivery.

These companies leverage commoditized logistics providers when efficient and take advantage of supply aggregation and packet consolidation to reduce transportation costs. But the real differentiation for these tech-enabled 3PLS is in their technology moats.

Cubbo, for instance, built a proprietary tech stack that includes a warehouse management system, order management system, and delivery decisioning engine—selecting carriers for the last-mile based on the best SLAs and price.

B2B marketplaces. As B2C e-commerce resets expectations around fulfillment and logistics, small business owners and enterprise procurement leaders, too, will start to demand similar digital solutions for their procurement needs. Today, this process is often done via phone, SMS, fax, and wires with product discovery mostly done in person and based on personal relationships.

But the existing process is ripe for disruption. Exciting digital companies are emerging across a number of verticals: Tul and Oico both provide building materials and tools for construction contractors; Dolado, Chiper, and Inventa compete for cornershops and other SMB retailers; Morado and Miferia facilitate B2B marketplaces for beauty and cosmetics products; and Meru and Wherex are more enterprise procurement solutions that connect manufacturers directly with customers.

Food supply chain. The logistics infrastructure for produce transportation is an especially large and interesting vertical in Latin America that is ripe for disruption: Today’s food supply chain is bloated with multiple middlemen that sit between producers and consumers, taking margin away from producers while inflating prices for consumers.

Asset-light restaurant procurement solutions Cayena and Floki are seeking to solve this issue by digitizing the procurement process for buyers, establishing price transparency across restaurant purchasers while serving as a channel partner for suppliers. Others like Frubana, Calii, Alima, and Clicampo are looking to cut out the middlemen altogether, connecting producers directly with buyers.

What’s Next

Latin America is in the early stages of a Cambrian explosion in supply chain innovation, and we have a strong conviction that the next large and enduring supply chain technology companies are being built by bold entrepreneurs in the region today. If you’re a founder, shoot us a note.

We’d love to hear from you:

Steve Sloane: [email protected]

Feyza Haskaraman: [email protected]

Derek Xiao: [email protected]

Steve is a partner at Menlo focused on investments in Menlo’s Inflection Fund, which targets fast-growing Series B/C companies. He specializes in AI-powered vertical SaaS investments and supply chain technology, including Enable, Eleos, Observe.AI, Scout, 6 River Systems, ShipBob, CloudTrucks, and Parade. Steve joined the firm in 2015 as an…

As a principal at Menlo Ventures, Feyza focuses on soon-to-breakout consumer, fintech, and enterprise SaaS companies. Prior to Menlo, Feyza worked as an engineer at various companies in different growth stages, including Nucleus Scientific (now Indigotech), Fitbit, and Analog Devices. Her exposure to a wide range of tasks and opportunities…

As an investor at Menlo Ventures, Derek concentrates on identifying investment opportunities across the firm’s thesis areas, covering AI, cloud infrastructure, digital health, and enterprise SaaS. Derek is especially focused on investing in soon-to-be breakout companies at the inflection stage. Derek joined Menlo from Bain & Company where he worked…