I recently found myself wondering how venture returns correlate to public market performance during market turbulence.

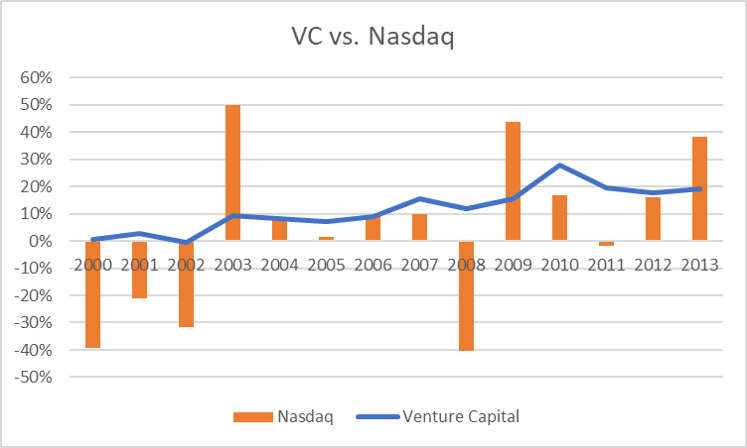

By comparing the pooled venture capital performance by year (Cambridge Associates) against the annual Nasdaq return, we can hone in on a few interesting data points. Notably, venture capital vintages (year of fundraising) tend to recover in line with the stock market; when the Nasdaq surged in 2003, funds raised in that year improved their performance from -0.5% to 9.2% IRR. In 2009–2010 the trend was similar, with ’09–10 VC IRRs nearly double (average of 21.6%) the 2008 vintage (11.9%).

At first, this seemed counterintuitive to me. After all, when investing at the bottom of the cycle with the long-term focus of venture capital, it would stand to reason that lower entry prices in a downturn might correlate with higher long-term IRRs. However, as that doesn’t seem to be the case, I was curious about which factors might be influencing that.

First, unlike public companies, early venture-backed startups generally have a more limited cash-runway, and so the risk of failure due to illiquidity is much higher. Even if you invested in a company that would have otherwise been able to attract follow-on financing during boom times, a recession generally correlates with fewer and smaller investment rounds and more cautious investors. Without this follow-on funding, more companies will fail, and returns will be depressed.

As you can see below (Forbes with Truebridge data), the amount of capital raised by venture funds declines precipitously in the years following a recession and takes several years to recover. Many LPs allocate funds to venture capital as a percentage of their total portfolio, which contributes to a prolonged decline in fundraising. Ten percent of a $10 billion portfolio is $1 billion at the market peak but only $500 million if markets decline by fifty percent. Only when the market has fully recovered can new fundraising reach previous levels.

Additionally, private valuations may adjust more slowly than public comps. As a result, while public stocks can sell off rapidly (in a period of days as we’ve seen recently), there is no real-time re-pricing mechanism for the private market. So, it’s certainly possible that investing in low periods neither gets you beneficial pricing nor a liquidity backstop.

So, it bears the question—is it better to invest in public stocks during extreme sell-offs? With a crystal ball and the ability to time the bottom of the market, equity gains coming out of recessionary periods can be quite compelling (the Nasdaq was up 50% in 2003 and 44% in 2009). In 2000, investing as the bubble burst would not have paid off well, as the market declined another 53% in the subsequent two years, and took nearly seven years to get back to even. However, post the 2008 crash, the Nasdaq recovery was much quicker, and public IRRs would have been quite compelling. Like most things in investing, the answer isn’t obvious! I’d love to know what you think.

Steve is a partner at Menlo focused on investments in Menlo’s Inflection Fund, which targets fast-growing Series B/C companies. He specializes in AI-powered vertical SaaS investments and supply chain technology, including Enable, Eleos, Observe.AI, Scout, 6 River Systems, ShipBob, CloudTrucks, and Parade. Steve joined the firm in 2015 as an…